Mining opportunities in SADC will favour those in the know

With mining seeing a more sustained improvement in many Southern African Development Community (SADC) countries, miners, and supply partners with experience on the ground are set to have greater gains in the coming year.

Miners in the region are not only currently enjoying high commodity prices, but also benefiting from improved supply chains, despite the global disruptions because of the pandemic, and stronger production performances, marking an encouraging first half of the year for the sector. The positive trend is set to continue in the second half.

This year’s Investing in African Mining Indaba, the first in-person event in two years, has further bolstered this sentiment. The event again emphasised the fact that mining and agriculture are key economic drivers in economies in Southern Africa.

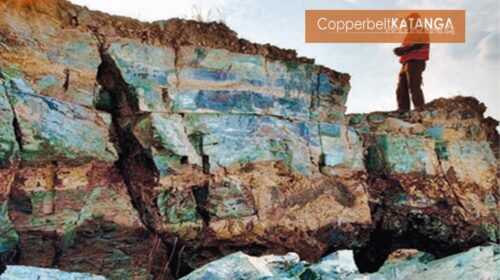

Strong commodities include iron ore, platinum group metals, gold, manganese, copper and cobalt, benefiting the economies especially of South Africa and Zambia. Improving prospects for diamonds, uranium and coal also make for some optimism in countries like Botswana, Namibia and Angola. In the longer term, there is a hopeful outlook for platinum and other minerals in Zimbabwe.

It is hoped that through constructive dialogue, gradual improvements in supply chains can be ascertained, which will affect the cost of doing business in these economies.”

The key to mining success in the region, however, lies not with commodity prices; these will always be cyclical and unpredictable. It resides really in the institutionalised knowledge of the companies that operate here, and their understanding of how to respond constructively to the prevailing conditions and future trends.

Dealing with supply chain issues

Among these considerations is supply chain security. As a supplier of critical mining inputs like explosives, BME often deals with supply chain issues such as weak infrastructure to border efficiency. It is hoped that through constructive dialogue, gradual improvements in supply chains can be ascertained, which will affect the cost of doing business in these economies.”

Another consideration is evolving regulations on local business participation and a heightened concern with safety and environmental impact. Responsible mining companies have embraced these principles, and it has long been standard procedure for service providers to align with the stringent expectation of zero-harm.

As the mining sector strives towards shared value, practical empowerment measures call for more proactive partnerships with in-country entities. Those industry players with a long heritage in SADC can draw more readily on their business networks to implement this vision. They will also see the value in preparing in advance to meet localisation imperatives. While some countries in the region have well-developed regulatory frameworks on this score, others are yet to implement their plans. It will be vital to be well-informed of future demands on business, and to plan decisively. These in-country partnerships also imply investment in local infrastructure and skills transfer, to build capacity in the local supply chains upon which mines are built.

A firm understanding of compliance requirements goes together with building a secure value chain that delivers fit-for-purpose solutions. Only if a mine can rely on receiving the inputs it needs, can it generate a secure future for itself and its host communities.

It is worth adding that mines are generally well supported by their key suppliers when it comes to achieving their social licence to operate, including the engagement and upliftment of host communities.

In-country partnerships allows companies to build capacity in the local supply chains

Re-looking operational efficiencies

In line with global trends, mining in Southern Africa is seeing the active acceptance of environmental and commercial sustainability. A decrease in greenfield investment opportunities, paired with higher environmental and regulatory hurdles to start new mines, has led to an increased focus on improving operational efficiencies. It is also a direction driven strongly by technological innovation. As the sector pursues the goal of smart mining operations, the region’s miners are applying digital tools to streamline activities, further raising efficiencies, and reducing carbon emissions.

We are seeing this first-hand in the blasting sector, where the use of software, electronic detonators and other digital tools are constantly fine tuning both the quality of blasting and the productive impact on the way mines work. By ensuring better fragmentation, for instance, energy use is optimised in downstream functions like loading and comminution – leading to less power consumption and a lighter carbon footprint.

Few of these innovations can be achieved, however, without decades of experience in the field, where mines and technology providers can develop and apply their technical insights. Nowhere is this currently more telling than in the field of data generation, gathering and analysis. As mines look to leverage real-time information from every machine and function on their sites, so technology must be developed to interrogate data for better and quicker decision making.

Not only must this data be intelligible and useful, but it must also be integrated into the mine’s chosen platforms. This has required suppliers of services, equipment, and materials to develop a depth of expertise in the digital space so that – whatever their core offering to mines – it can be tracked, measured, and assessed through the mine’s dashboard.

Beyond the operational efficacy of such systems, mines and their partners must also be aware of how best to ensure the security of this data – and comply with evolving local regulations governing data protection. Once considered a niche field for technology specialists, data management is increasingly becoming core to every sector including mining. The mineral opportunities of the SADC region remain exciting to all of those involved. It is the task of the mining sector to realise those prospects in the most responsible and sustainable way – sharing the value with a broad base of stakeholders. Those with local experience and expertise are best placed to do this.

41 total views , 1 views today