Saudi Arabia’s PIF Leads Bidding for $2.5 Billion Vale Base Metals Stake

Saudi Arabia’s Public Investment Fund is emerging as the leading bidder to acquire a stake in Vale SA’s multibillion-dollar nickel and copper operations, people with knowledge of the matter said.

PIF is in advanced discussions with the Brazilian miner about a deal for a roughly 10% holding in its base metals unit, according to the people, who asked not to be identified discussing confidential information. The stake could be valued at around $2.5 billion, they said.

The wealth fund is poised to beat out rival bidders including Japanese trading house Mitsui & Co. and the Qatar Investment Authority, the people said. It may take at least several weeks to hash out a formal agreement, the people said.

PIF may do the Vale deal through a joint venture it set up in January with Saudi Arabian state miner Maaden. The JV, established to take minority stakes in iron ore, copper, nickel and lithium businesses, is part of Saudi Arabia’s efforts to diversify its economy from oil and secure access to strategic minerals.

Deliberations are ongoing, and talks could fall apart or another buyer could emerge. Spokespeople for PIF and Maaden didn’t immediately provide comment or couldn’t be reached. Representatives for Mitsui and QIA declined to comment.

Vale said that, at this stage, it cannot confirm the amount of an eventual investment nor the parties involved, according to a statement. Shares of Vale were down 2.3% as of 11:14 a.m. in Sao Paulo.

Unlocking Value

Vale hired advisers last year to assess options for the business, amid soaring demand for metals like copper and nickel that are key to the global push to cleaner forms of energy.

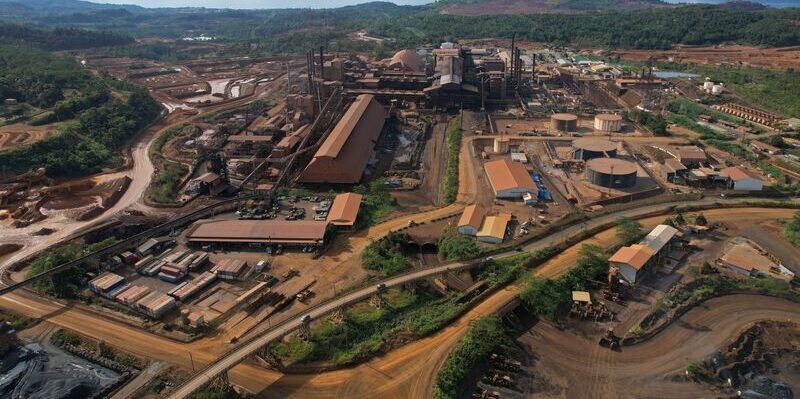

The Rio de Janeiro-based company operates nickel and copper mines in countries including Brazil, Canada and Indonesia, many of which were acquired through the $17 billion purchase of Canada’s Inco Ltd. in 2006.

Vale has been looking to separate its prized iron ore mines from its base metals business to unlock value from assets the company considers undervalued by the market.

Creating a base metals entity with independent governance would also allow Vale to better position the business as a battery-metal supplier during a period of increasing demand from the energy transition.

Chief Executive Officer Eduardo Bartolomeo has been seeking a strategic partner with expertise to help improve its base metals operations.

Cash raised from the sale will help finance an estimated $20 billion in investments to accelerate growth of the business. Bartolomeo sees the potential for the base metals unit to become as big as Vale’s iron ore company.

Vale is still discussing future steps for the business, with an initial public offering as an option down the road.

![]()