What Investors Should Know About Cobalt Supply Chains

Cobalt is a key element in the lithium-ion batteries used to power EVs, and even though prices are far away from those highs, the long-term future of the metal is still quite bright.

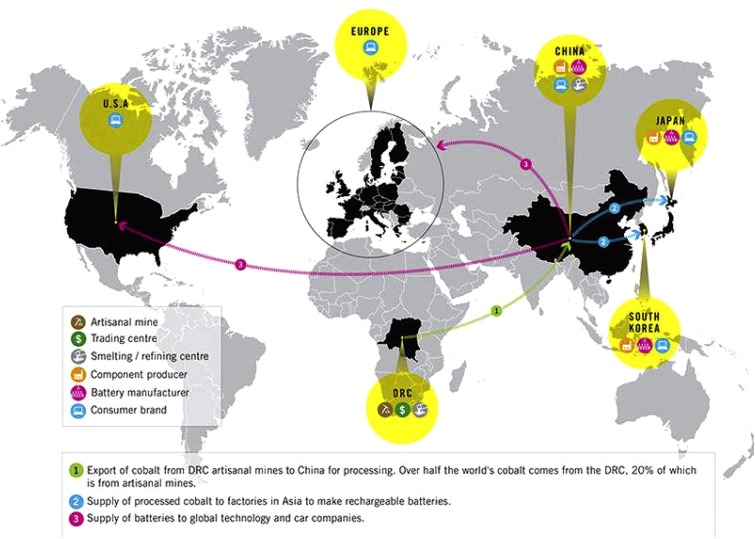

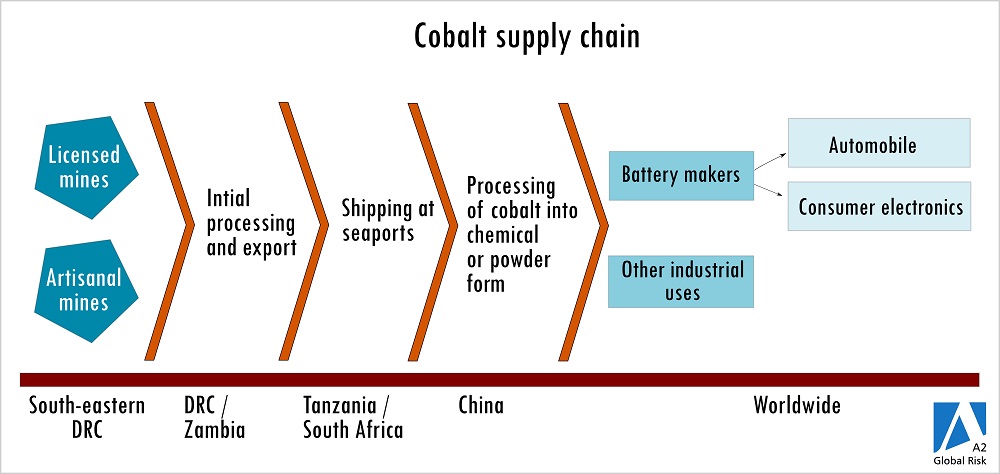

When looking at the cobalt supply chain, there are two countries that dominate. On the mining side, the Democratic Republic of Congo (DRC) takes the lead, with Benchmark Mineral Intelligence forecasting that the country will make up about 75 percent of the total market up to 2025.

Those are not the only key aspects of cobalt and its supply chains that investors should consider. Read on for an overview of what every investor should know about cobalt supply chains.

Supply chains: Cobalt metal versus chemicals

When looking at the cobalt market, one of the first things to understand is that cobalt metal and cobalt chemicals have distinct supply chains.

Cobalt metal is mined at primary cobalt mines and as a by-product at nickel and copper mines. From there, the cobalt concentrates or intermediates are sent to metal refineries, which are usually close to the mines sites; at refineries, end products used in a variety of industrial applications are created.

Cobalt’s ability to stand up to high temperatures and its good oxidation resistance make it an important alloying element for superalloys, which are used for casting airfoils and in other structural parts of jet turbine engines. Other end-use markets include industrial hard facing/cutting and medical devices.

The cobalt chemical supply chain also starts at the mine level, where concentrates or intermediates are produced. They are then sent to chemical refineries; as mentioned above, most chemical refineries are in China, and the majority of chemical supply ends up in EV batteries.

The cobalt metal and chemical supply chains share some risks, but also present separate risks as well.

“Of course both markets are linked, but as they have quite separate supply chains and end-use markets they can behave differently,” Benchmark Mineral Intelligence Head of Price Assessment Caspar Rawles told the Investing News Network.

Generally speaking, the chemical supply chain uses DRC hydroxide as a feedstock and lithium-ion batteries are the major end market, as mentioned above.

“So you can see prices react to either a supply squeeze purely in the DRC and/or an increase in demand from the battery market,” he said.

Looking at the cobalt metal supply chain, no cobalt metal has been produced in the DRC for some time.

“Most metal is produced outside of China using feedstock from non-DRC mines — so this CSR issue is less of a risk,” Rawles said. “Chinese-produced cobalt metal does use DRC material as feedstock, but we haven’t really seen a large amount of export of Chinese metal recently for various reasons.”

Another key difference between these supply chains is their outlook.

“(The end use) markets (for cobalt metal) undergo separate demand strains and aren’t expected to undergo the rapid growth levels in the battery supply chain,” Rawles said.

Benchmark Mineral Intelligence forecasts that cobalt use in batteries will grow over 130 percent over the next five years.

“Industrial markets have a limited growth outlook in the single-digit percent growth rates, and due to the impacts of the COVID-19 pandemic, aviation demand is likely to contract in the coming years — so you can see there are quite different outlooks,” he added.

Supply chains: Cobalt refining and China’s dominance

As with many other key raw materials, China’s dominance is also present in the cobalt space, in this case in refining the metal for the battery supply chain.

For Rawles, the two key reasons why China has ended up dominating in this segment are the Chinese government’s mandate to be a global leader in the battery supply chain and in costs.

“The rest of the world is only really waking up to the global battery arms race now. China has been focused on this for many years,” he said. “Chinese companies have taken huge market share, not just in cobalt chemical refining, but along the supply chain for all minerals.”

Supply chains: How to build and localize

Benchmark Mineral Intelligence, which tracks the global buildout of lithium-ion battery production capacity in its mega factory assessment, sees China controlling about 70 percent of battery production over the next decade.

“But the world is looking to semi-localize supply chains, and we are seeing a big push for this with new production facilities being planned, particularly in Europe,” Rawles said. “Having said this, these new facilities seem to be largely focused on the cathode and battery sections of the supply chain, and little in the pipeline for chemical refining.”

The reasons for this vary, but the challenges to building out refineries are usually related to costs and the time it takes to get through the process/permitting.

“But as for many countries, batteries and wider electrification are becoming a matter of national importance, so there are a growing amount of incentives, both financial and legislative, which have made things easier,” he said. “Even so, there is a long way to go to catch China for much of the supply chain, and therefore we expect it to remain dominant for the foreseeable future.”

For Rawles, the opportunity for countries aiming to build their supply chains is huge.

“It could be a wholesale shift in auto industry supply chains, which have been relatively static for years,” he said. “Beyond EVs, there is also the opportunity for energy storage systems markets, which have massive potential for growth.”

At the same time, there is a big downside risk for countries that have a large auto manufacturing sector, such as Germany.

“These countries face significant job losses if they don’t continue to attract the new manufacturing bases, which will ultimately replace traditional internal combustion engine supply chains,” he said.

By Priscila Barrera

Source: investingnews.com