World’s cobalt supply deficit is shrinking, says S&P

A market deficit for cobalt is shrinking as the world’s top producers of the prized metal expand production to meet the demand for batteries used in electric vehicles (EVs), according to a new report by S&P Global Intelligence.

With a spoke in EV sales this year, demand for cobalt drove major producers to plan to increase output at mine sites in the Democratic Republic of Congo (DRC) and balance the market, says S&P.

Some EV-makers have begun seek alternatives to the battery metal, which provides stability to the battery cathode, but is costly and linked to allegations of human rights abuses of artisanal miners in the DRC. Market Intelligence says the metal will likely continue to play a key role in rechargeable batteries in cars and on the grid, at least for the short term.

The market is expected to move into surplus in 2022 after suffering an estimated shortage of 1,800 tonnes of refined cobalt this year, according to S&P Global Market Intelligence’s latest forecast published on September 22.

“The situation is not as dire as it was,” Caspar Rawles, head of price assessments at Benchmark Mineral Intelligence, said in an interview. “The supply chains have responded, and I think the cobalt picture does look a lot better.”

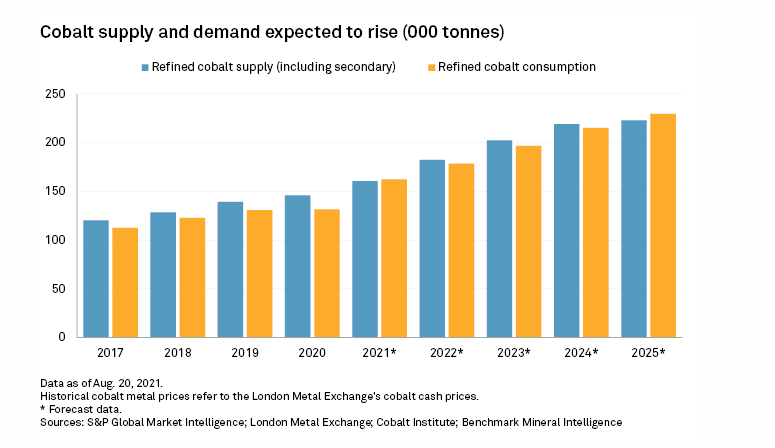

Global refined cobalt production is expected to rise 38.5% between 2021 and 2025, reaching 223,000 tonnes, according to S&P Market Intelligence, due to the expansion and restart of multiple production sites. Top producers Glencore and China Molybdenum are planning to boost production at mines in the DRC in the coming years. About 68.6% of the world’s 139,480 tonnes of cobalt supply last year came from the DRC, followed by 4.2% from Australia and 3.3% from the Philippines.

Swiss commodities giant Glencore could revive production at its copper-cobalt Mutanda mine in the DRC, S&P Market Intelligence reported on May 26. Glencore declined a request for comment, but it addressed the mine in a recent earnings call.

“We are starting the ramp-up, starting to come back into production [at Mutanda],” CEO Gary Nagle said on the August 5 call. “We will take our time with the ramp-up to ensure we can match the supply that comes from Mutanda with the demand growth that we see in the market.”

Glencore halted operations at the Mutanda mine and placed it on care and maintenance at the end of 2019 after cobalt prices dropped due to increasing production from China and oversupply, but plans to restart it next year.

China Molybdenum, the world’s second-largest cobalt producer by volume, plans to pump $2.51 billion into its 80%-owned Tenke Fungurume copper-cobalt mine in the DRC by 2023, increasing cobalt production capacity by 17,000 tonnes. In 2020, the mine’s cobalt output totaled 15,436 tonnes, according to Market Intelligence data.

A semiconductor chip shortage softened the need for cobalt, and the continuing spread of the covid-19 and glitches at a port in South Africa have continued to upend several parts of the supply chain as well, according to Market Intelligence analyst Alice Yu.

In July, China imported over one-fifth less cobalt from the DRC compared to the same month in 2020.

But supply in 2021 cannot meet current demand, and prices for the metal have rallied, says S&P.

Cobalt prices will be an estimated 50% higher in 2021 than in the year prior, according to Market Intelligence data, but prices could cool down in 2022, analysts say, as supply chain constraints ease and increased output from expanded mine projects in the DRC enter the market.

![]()