Zambian Government will not forgo mining-generated revenues again

Government set out its plan to revive Zambia’s economy during last week’s Public Symposium on the 2023 National Budget, held on Monday 3 October 2022. Mining For Zambia shares the key takeaways.

Having secured an IMF-supported program in September 2022 to assist with managing the country’s debt, growth is now at the top of Government’s agenda. Minister of Finance and National Planning, Hon. Dr. Situmbeko Musokotwane, said: “A Budget can be – and is – an instrument for economic growth. Growth is what is going to take us out of this poverty and generate money for social spending.”

Minister Musokotwane explained that a few critical sectors – including mining – have been specifically targeted to drive economic growth. “We are pushing very hard to create conditions that will allow production in the economy to rise. As that happens and more people get employed, we can shift away from depending on relatively few people in formal employment for taxation, and spread that [tax] burden across a wider section of society.”

Creating conditions to support the productive sectors, as the 2023 Budget aims to do, is key for expanding a country’s tax base, according to economists.

Mr Ibrahim Kamara of the Zambia Tax Platform took the opportunity to question the logic behind Government’s move to adjust the mining sector’s mineral royalty regime so that it operates on a similar basis to PAYE, saying that this might lead to a reduction in tax revenue. His comment echoes some of the views expressed in local media last week.

The government responded directly by articulating the thinking that has informed its approach, and the need to set in motion a mining-led economic growth trajectory. Mr Nkulukusa pointed out that in excess of $3 billion in mining investment pledges were forgone in 2015 when ill-conceived changes to the mineral royalty tax regime were introduced.

Mr Nkulukusa quantified the forgone revenue: “Use an Excel spreadsheet, put in 6% mineral royalty, plus income tax, and the revenue that Government would have been collecting now (depending on the price of copper) would have been between $2 billion and $4 billion. If those investments had come through [in 2015], by 2017 we would have been producing about 1.5 million tonnes of copper.”

He added that First Quantum Minerals’ $1.36 billion investment to extend the life of mine at Kansanshi Copper Mine and bring Enterprise Nickel Mines online, announced in May 2022, has been waiting in the wings since 2014. “You can imagine how much revenue we have lost out by delaying that investment, and how much we have lost out in terms of copper production!”

Instead, by bringing Zambia more in line with other copper-producing jurisdictions – with which it competes for investment capital – Government aims to avoid forgoing mining-generated revenues in the future.

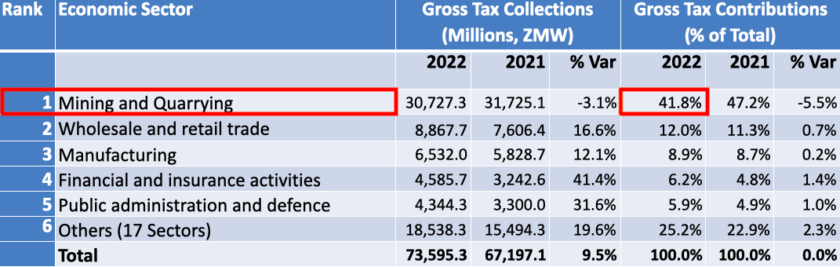

Measuring mining’s fiscal contribution

Also of interest was data presented by Commissioner General of the Zambia Revenue Authority (ZRA), Mr Dingani Banda, which illustrates the mining sector’s contribution to Government revenue. “Contrary to public perceptions about mining not contributing much to Government revenue, our figures show the opposite,” said Mr Banda. The mining sector contributed 41.8% of all Government revenue between January and August 2022, he revealed.

Mr Banda also communicated the fact that just five out of the country’s 22 sectors account for 75% of revenues collected by ZRA, which emphasises just how significant mining’s contribution is to Zambia. This data should alleviate concerns about potential revenue losses. It also reinforces the view that, in Zambia, a thriving mining sector is essential for creating a thriving economy.

![]()