ZCCM IH Board Director Bishop Mambo tells Chinese Mining Firm to Start Paying Dividends to Govt

The ZCCM IH Board has learnt that Non Ferrous China Africa Corporation (NFCA) Mining on the Copperbelt has not been paying dividends for eleven years to the Government, which is a share holder in the firm.

The Government through ZCCM IH owns shares in NFCA, a Chinese owned mining firm based in Chambishi, Kalulushi District.

Dividend is a sum of money paid regularly every year by a company to its shareholders out of its profits or reserves.

NFCA Africa Mining Plc was established in March 1998 as the holding company of Chambishi Copper Mine as part of the privatization of Zambia Consolidated Copper Mines Limited (ZCCM).

It is majority owned by China Non-ferrous Metals Company Limited (CNMC), which holds an 85% shareholding stake, whilst ZCCM Investments Holdings Plc holds a 15% shareholding stake.

The revelation that NFCA has not been paying dividends to the Government for 11 years came to light when ZCCM IH Board members visited the company on familiarization tour on Wednesday.

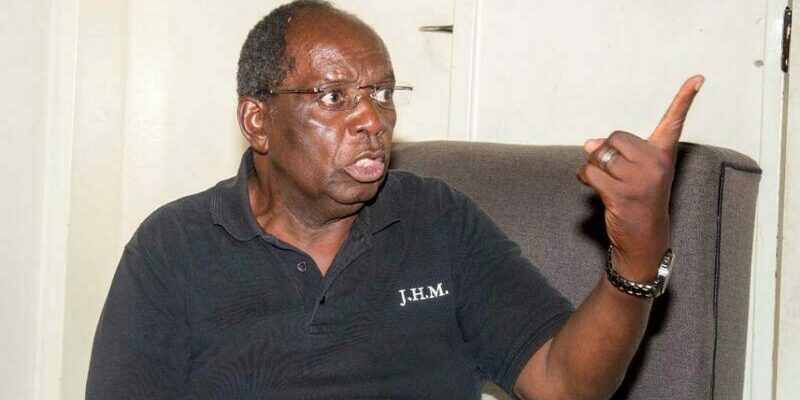

ZCCM IH Board Director Bishop John Mambo told NFCA Management to begin paying dividends to the Government starting in the 2021 financial year especially that the company is now recording profits and has a net asset position of over $100 million.

Bishop Mambo said NFCA, who have an investment of over USD 800 million, must increase its production in order to contribute to the country’s copper production target of Three Million Metric Tonnes.

He further called for consistency and timely submission of audited financial statements and the holding of board meetings within three months as stipulated by the company’s Act.

“NFCA with its significant investment of over $800 Million should look to increasing its production in order to contribute to the country’s copper production. The target of the New Dawn Government is 300 Million Metric Tonnes. At the back of this height copper price and an enabling business environment, NFCA share holders should benefit from these dividends. ZCCM IH should be able to attract value from its assets including this company which is NFCA. This include dividends and participation in the mining supply chain of the company despite being the minority ZCCM IH has a right that should be respected by the majority shareholders. There is need for local compliance on the administration side of the business,” Bishop Mambo said.

“Without sound corporate governance ZCCM I H will not maxmise and extract value from its assets which include title of the share in this company. I think the new Government really needs certain things to be done differently but we will respect the investor, you are really doing a great job. We want to see constant in timely submission of audited financial statements and holding of board meetings within the three months as stipulated in the company act. This is a law like in any country you have to follow that law but we look at the minutes and the new board, we see that in two years maybe you just have one meeting so have to ask many how do you run this company? We are very happy to note that the company is now recording profits and has an asset position of over $100 Million we therefore look forward to receiving dividends for the year 2021 financial year,” Bishop Mambo said.

NFCA Chairman Xu Helin said the firm experienced the impact of low copper price in 2014 and 2015 on Zambian mining industry coupled with the effects of Covid-19 in 2020.

Mr Helin, however, said the firm has adopted an advanced mining and mineral processing technology with good safety performance in order to build a digital benchmark mine in Africa and explore a new path for Zambia’s mining development.

Speaking through an interpreter, Mr Helin also talked about his company’s commitment to building a green and environmentally friendly mine.

![]()