Copper price up as China imports rise

Copper prices rose on Tuesday after China’s central bank eased monetary policy and as imports into the world’s top metals consumer climbed in November.

The People’s Bank of China said on Monday it would cut the amount of cash that banks must hold in reserve, releasing the funds in long-term liquidity to bolster slowing economic growth.

“China’s policy easing has sparked optimism; meanwhile, we have probably seen the worst in the property market,” said ING analyst Wenyu Yao.

Meanwhile, China’s copper imports in November rose for a third straight month, customs data showed, hitting their highest since March.

Arrivals of unwrought copper and products stood at 510,402 tonnes last month, higher than 410,541 tonnes in October but still down 9.1% from a year earlier.

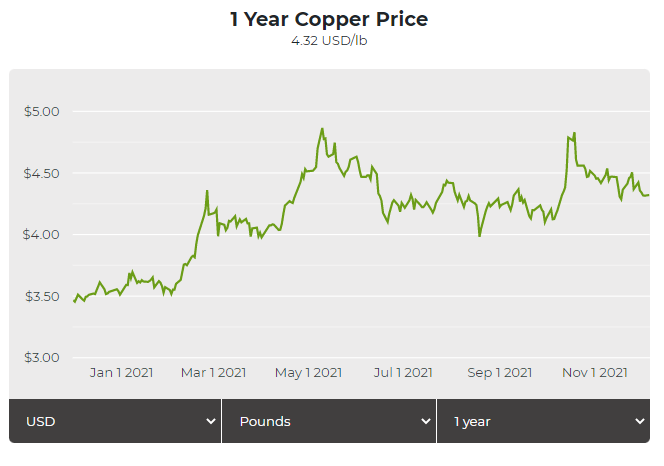

March delivery contracts were exchanging hands for $4.39 a pound ($9,435 a tonne) by midday on the Comex market in New York, up 1.4% compared to Monday closing.

“Given that this is just one month’s data, and that other indicators point to a further softening in demand from commodity end-users, we are sceptical,” said analysts at Capital Economics.

“Looking ahead, we expect shipments to remain strong into year-end, given signs that external demand is holding up. Even so, this external prop may not be sufficient to counter downward pressure on growth from domestic sources, including the cooling property sector,” said Bloomberg economist David Qu.

Top producer Chile saw exports of the red metal soar over 35% to $4.92 billion in November.

![]()