Barrick Sounds Out First Quantum Holders on Possible Bid

Barrick Gold Corp. has spoken with some of First Quantum Minerals Ltd.’s major investors to gauge their support for a potential takeover, after the sudden closure of its flagship mine left the Canadian copper producer reeling and wiped out more than half its market value.

Barrick Chief Executive Officer Mark Bristow approached some of First Quantum’s largest investors late last year, according to people familiar with the situation, who asked not to be identified as the talks were private.

It wasn’t immediately clear if Barrick has made a fresh approach to First Quantum, and there’s no guarantee it will make a formal offer.

Gold giant Barrick has been seeking to expand in copper, and a deal with First Quantum would transform the company into one of the world’s biggest producers.

The smaller Canadian miner has been left vulnerable after Panama ordered the closure of its biggest and most profitable asset, creating a potential opportunity for Bristow — an industry veteran with a history of building and running mines in challenging locations.

Bristow has been closely monitoring the situation since First Quantum’s problems escalated in October, one of the people said.

The CEO has said he is confident that Barrick could resolve the situation in Panama as well as run First Quantum’s African mines, the people said.

First Quantum’s biggest shareholder is the Capital Group with 22%, according to data compiled by Bloomberg.

China’s Jiangxi Copper Co. owns 18%, and is among those that have been approached by Barrick, the people said.

Spokespeople for Barrick didn’t respond to requests for comment. First Quantum declined to comment, while Jiangxi didn’t immediately respond to a request for comment outside of regular office hours.

First Quantum has long been on the radar as a potential target for the world’s biggest miners, in large part because the company’s Cobre Panama mine is one of the newest and biggest copper operations.

The industry’s key players are all seeking to expand production of the metal that is essential to decarbonizing the global economy.

Yet the Panama project has also proved to be the company’s biggest vulnerability. Cobre Panama became the focus of widespread protests after the government approved a new multidecade operating contract, and the company was forced to stop production because it couldn’t access supplies.

Panama’s Supreme Court subsequently ruled that the law governing the operating license was invalid, prompting President Laurentino Cortizo to order that the mine be closed.

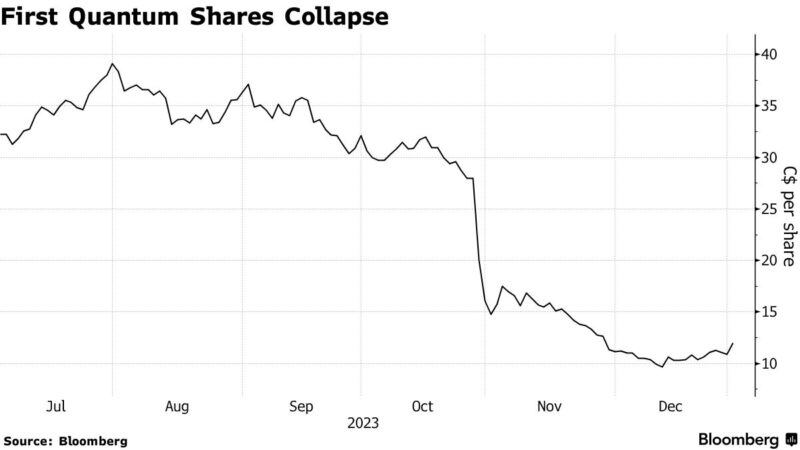

First Quantum’s share price collapsed as a result of the turmoil, shedding more than 60% of its value last year. The company is currently worth about $6.8 billion, while Barrick is worth about $30 billion.

Bristow has been looking to transform Barrick — formerly the world’s biggest gold miner — into a major copper producer.

The company is building a big copper mine in Pakistan, and previously made an informal takeover approach to First Quantum that was rebuffed, Bloomberg reported in June.

Bristow made his name building mines in some of the world’s most challenging places. At Randgold Resources Ltd. he built projects in Mali, Ivory Coast and the Democratic Republic of Congo, successfully navigating social and political unrest. When Barrick bought Randgold, Bristow was appointed CEO of the combined company.

An offer from Barrick would pile more pressure on First Quantum’s management, as the company struggles to find a solution to the sudden closure of its biggest profit generator.

The situation has raised questions about the company’s balance sheet, with billions of dollars of debt maturing in the coming years, and First Quantum has said it will release a plan in the new year outlining how it intends to manage without the mine.

SOURCE:.bloomberg.com

![]()