Anglo’s copper assets worth $35bn, report shows

Anglo American’s copper assets are valued at about $35-billion and, if BHP aims to clinch these prized operations, the miner must substantially enhance its offer for its competitor.

This is according to a report by CreditSight analysts Wen Li and Michael O’Brien, who estimate Anglo’s enterprise value at $63-billion.

BHP’s initial offer of $32 a share (£25) falls short of the mark, considering that CreditSight’s valuation corresponds to a share price of $39 (£31).

Market sentiment, as gauged from analysts and traders surveyed by Bloomberg converge around an average price of £30.43 a share for a potential deal, with responses ranging between £28 and £35.

Anglo has rejected BHP’s initial offer, asserting that it inadequately reflects the company’s true value and future prospects.

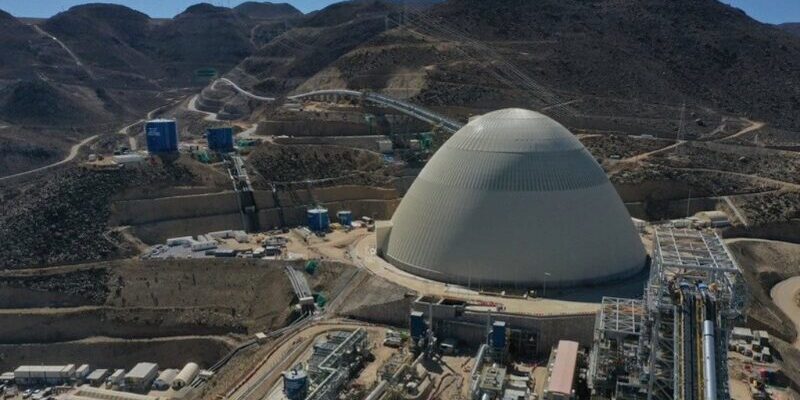

Anglo’s proposition boasts a large, high-margin and high-growth potential copper asset base in close proximity to BHP’s Chilean and Peruvian copper assets. A successful merger would culminate in the formation of the world’s largest copper miner, providing access to a trove of premier copper mines such as Collahuasi (ownership of 44%), Los Bronces (50.1%), El Soldado (50.1%) and Quellaveco (60%).

The amalgamated entity would produce 2.6-million tonnes a year of copper, accounting for about 10% of global production.

Recent news reports suggest BHP is contemplating an improved offer for Anglo. Under UK takeover rules, BHP has until May 22 to come back with a formal offer.

![]()