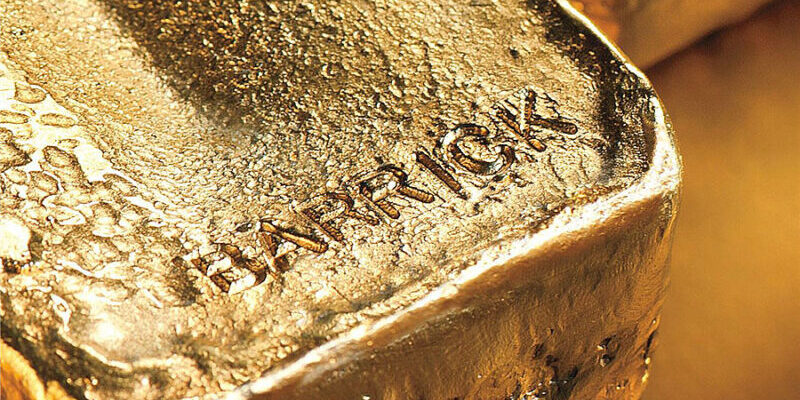

Barrick Gold Boosts Growth with Strong Portfolio and Strategic Investments

Barrick Gold Corporation (NYSE: GOLD) (TSX: ABX) is making significant strides toward securing its future with a Tier One-focused asset portfolio and a strategy that continually uncovers value while fostering productive partnerships with host countries.

At an investor presentation in New York, president and CEO Mark Bristow highlighted Barrick’s achievements since its merger, including generating $23 billion in operating cash flow, investing $15 billion in operations and growth projects, reducing net debt by nearly $4 billion, and returning over $5 billion to shareholders.

“Our world-class projects are set to drive a new growth phase, supported by targeted exploration programs that maintain Barrick’s exceptional record of reserve replacement,” Bristow said, emphasizing the company’s robust 10-year production outlook.

Barrick is expanding in Chile, Peru, and Ecuador while enhancing value within its existing portfolio. In Nevada, Barrick is making progress with mine extension projects at Leeville, Goldrush, Hanson, Robertson, Swift, and Turquoise Ridge.

The newly permitted Goldrush mine is ramping up, and the adjacent Fourmile property, 100% owned by Barrick, is emerging as a world-class asset.

A preliminary economic assessment at Fourmile shows the potential for annual operating cash flows at least 70% higher than the already impressive Goldrush project.

Bristow underscored the company’s holistic approach to sustainability, stating that it supports Barrick’s business strategy by maximizing asset value, building a world-class copper business, and fostering partnerships that benefit all stakeholders.

This approach strengthens Barrick’s balance sheet and enables disciplined shareholder returns while attracting top talent aligned with the company’s values.

![]()