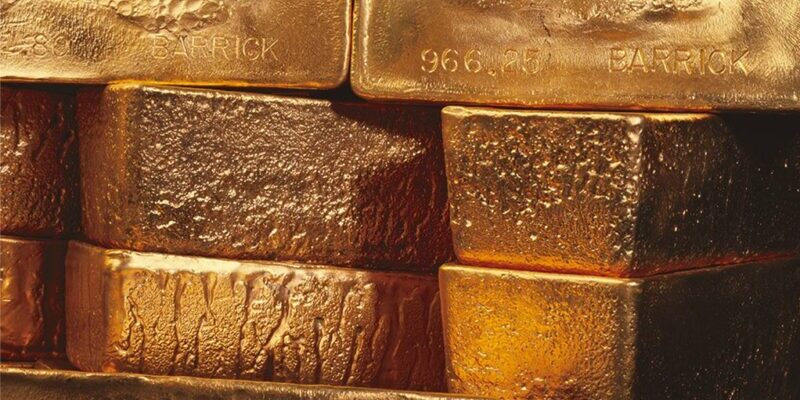

Barrick Gold Seeks Buyer for Côte d’Ivoire’s Tongon Mine Amid Gold Price Surge

Barrick Gold Corp., the world’s second-largest gold producer, is seeking buyers for its Tongon gold mine in Côte d’Ivoire as part of its strategy to divest aging assets while gold prices remain high.

Barrick has partnered with Toronto-Dominion Bank to identify potential buyers and solicit bids for the mine, according to sources familiar with the matter. Neither Barrick nor TD Bank has commented on the sale.

Located 682 km north of Côte d’Ivoire’s port city of Abidjan, Tongon is an open-pit mine nearing the end of its operational life. Production is slated to cease by 2027 due to declining resources. Barrick owns nearly 90% of the mine, while the remaining stake is held by the Ivorian government and local investors.

The Tongon mine produced 204,000 ounces of gold in 2023, contributing approximately 5% to Barrick’s total annual output. However, the company has classified the mine as a non-core asset, with plans to improve its portfolio quality and reduce operating costs.

According to Sebastiaan Bock, Barrick’s COO for Africa and the Middle East, divesting the mine could lower the company’s cost profile by more than $50 per ounce.

The sale comes as gold producers benefit from record-high bullion prices driven by robust central-bank purchases, geopolitical tensions, and interest-rate reductions. This favorable market has boosted valuations for mining assets.

For example, Newmont Corp., Barrick’s leading rival, has raised $3.9 billion in 2024 from mine sales, almost double its original divestment goal.

Newmont’s Akyem mine in Ghana attracted bids from several Chinese firms before being sold to Zijin Mining Group for $1 billion.

Barrick had previously explored selling Tongon in 2019 but did not complete the transaction. At a recent investor event, the company reiterated its intention to evaluate strategic options for the mine as it focuses on core operations and maximizing portfolio value.

By selling Tongon, Barrick aims to capitalize on the current market while reducing costs and strengthening its global operations.

![]()