Copper price set for smallest quarterly gain since March 2020

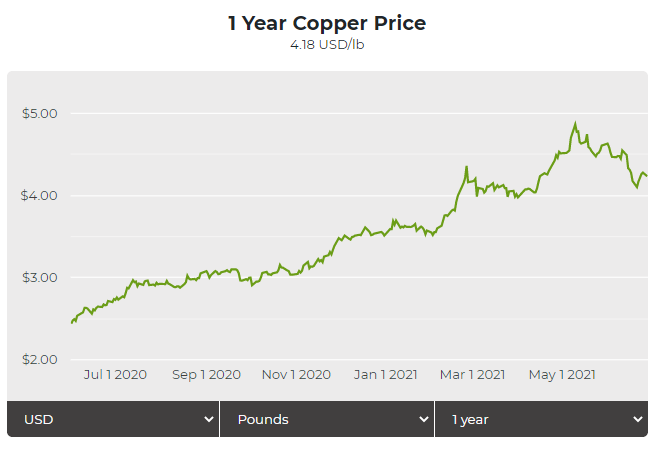

Copper prices rose on Wednesday but were set for their smallest quarterly gain since March 2020 on pressure from a firm dollar and China’s efforts to tame a red-hot metals rally.

Copper for delivery in September rose 1.6% from Tuesday’s settlement price, touching $4.335 per pound ($9,537 per tonne) midday Wednesday on the Comex market in New York.

The most-traded August copper contract on the Shanghai Futures Exchange dipped 0.3% to 68,050 yuan a tonne, set for the weakest quarterly gain since March 2020 when China’s recovery from the covid-19 pandemic aided metals prices.

China recently released state reserves of copper, aluminum, and zinc as part of its pledge to control a recent surge in commodities prices.

“For the next quarter, it will be all about how much demand from the rest of the world will be able to offset a slowing China. Most of that will depend on the success of finally getting the virus under control and seeing supply chains recover,” commodities broker Anna Stablum of Marex Spectron told Reuters.

“Aluminum has got a chance to outperform as the environmental restrictions in China will continue to weigh on supply and it seems like the nickel market looks pretty tight,” she added.

Expectations of sooner-than-anticipated policy tightening in the United States have also made greenback-priced metals more expensive and less appealing to holders of other currencies.

![]()