Gold price rebounds on ceasefire setback – Goldman targets $2,500

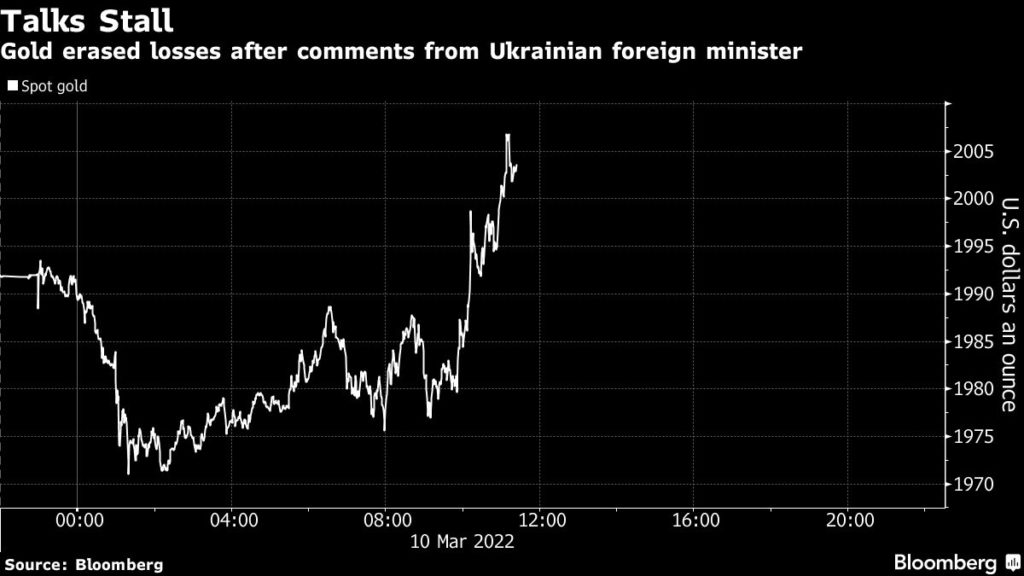

Gold rebounded and rose above $2,000 once again on Thursday after talks between Ukraine and Russia failed to make any progress in halting what is considered the biggest European military crisis since World War II.

Spot gold advanced 0.5% to $2,000.69 per ounce by 12:30 p.m. ET, maintaining its highest level since August 2020. Three-month US gold futures were 0.7% higher, trading at $2,003.10 per ounce on the Comex.

Bullion had earlier extended its biggest decline in 14 months on hopes that talks between the countries’ foreign ministers could lead to a diplomatic solution. However, Ukrainian Foreign Minister Dmytro Kuleba said Russia indicated it will continue attacks until its goals are met, a sign of how far apart the two sides remain.

The lack of momentum on a potential ceasefire reignited risk sentiment across global markets, lending support to gold, which alongside various other commodities such as oil and wheat have fallen from recent highs.

Meanwhile, concerns remain over the threat of an inflationary shock to the global economy just as the Federal Reserve prepares to raise interest rates. US inflation accelerated to a fresh 40-year high in February prior to the recent spike in energy prices.

“Investors will continue to buy gold as an inflation hedge,” Georgette Boele, a senior precious metals strategist at ABN Amro Bank NV, wrote in a Bloomberg note.

“But as the Fed will continue to hike and we also expect a higher dollar, gold’s fortunes will mainly be positive versus other currencies than the dollar.”

Perfect storm

Jeff Currie, global head of commodities research at Goldman Sachs, believes gold is in a sweet spot at the moment.

“In fact, it’s perfect gold for storm right now,” Currie said in a Bloomberg interview Wednesday, citing growing investor demand, central bank buying and strong physical demand in the last quarter.https://www.youtube.com/embed/2I_fPtb2khk?feature=oembed

“It’s the strongest demand for all three channels that we’ve ever seen. The last time we saw this type of demand stream across the board was in 2010-2011, and gold rallied 70%,” he said.

“Our target is $2,500, which is another $500 of upside from here.”

![]()