Ivanhoe Mines Issues Third Quarter 2024 Financial Results

Ivanhoe Mines’ (TSX: IVN) (OTCQX: IVPAF) President Marna Cloete and Chief Financial Officer David van Heerden are pleased to present the company’s financial results for the three and nine months ended September 30, 2024.

Ivanhoe Mines is a leading Canadian mining company developing and operating its four principal mining and exploration projects in Southern Africa: expanding production at the world-class Kamoa-Kakula Copper Complex in the Democratic Republic of Congo (DRC); ramping up the ultra-high-grade Kipushi zinc-copper-lead-germanium mine in the DRC; building the tier-one Platreef palladium, rhodium, nickel, platinum, copper and gold development project in South Africa; as well as exploring and advancing the expansive exploration licenses of Ivanhoe’s Western Forelands project, which hosts the Makoko, Kitoko, and Kiala copper discoveries near Kamoa-Kakula. All figures are in U.S. dollars unless otherwise stated.

Founder and Co-Chairman Robert Friedland commented:

“Kamoa-Kakula has reached a major milestone with the ramp-up of the Phase 3 expansion. Phase 3 provides steady-state milling capacity of 600,000 tonnes of copper per annum.

We have reached the top tier of the world’s most significant copper complexes, which at every phase were delivered ahead of schedule … a true rarity in our industry.

“Africa’s largest and greenest copper smelter is nearing construction completion this year. The smelter will reduce cash costs and improve profitability.

With capital expenditures largely behind us at Kamoa-Kakula, we look forward to a period of strong profit and free cash flow, even as we continue to advance further copper growth initiatives on the joint venture.

“We expect 2025 to be a banner year as we deliver these significant production milestones, as well as advance our industry-leading exploration efforts in the Western Forelands, which continue to deliver some of the world’s most significant, tier-one copper discoveries.”

FINANCIAL HIGHLIGHTS

- Ivanhoe Mines recorded a profit of $108 million for Q3 2024 compared with a profit of $108 million for Q3 2023. Ivanhoe Mines’ normalized profit for Q3 2024 was $112 million, compared with a normalized profit of $95 million for Q3 2023.

- Kamoa-Kakula sold 103,106 tonnes of payable copper during Q3 2024, recognizing revenue of $828 million, an operating profit of $392 million, and quarterly EBITDA of $470 million. Concentrate produced from Phase 3 is being toll-treated into blister copper at the Lualaba Copper Smelter (LCS) to maximize profitability until the on-site smelter is completed. As such, total inventory, including in the on-site warehouse and at LCS, increased to approximately 16,000 tonnes of copper in concentrate at the end of the quarter.

- Kamoa-Kakula’s cost of sales per pound (lb.) of payable copper sold was $1.80/lb. for Q3 2024 compared with $1.53/lb. and $1.34/lb. in Q2 2024 and Q3 2023, respectively. Over the first nine months of 2024, cost of sales per pound (lb.) of payable copper sold was $1.62/lb.

- Cash cost (C1) per pound of payable copper produced in Q3 2024 totaled $1.69/lb., compared with $1.52/lb. and $1.46/lb. achieved in Q2 2024 and Q3 2023, respectively. Cash cost (C1) per pound of payable copper produced for the nine months ended September 30, 2024, was $1.60/lb., in line with the mid-point of guidance.

- Cash cost was impacted by the ramp-up of the Phase 3 expansion, including the drawing of lower-grade surface stockpiles to supplement the ramp-up process, and the optimization of the concentrator circuit towards nameplate recoveries of approximately 86%. The ramp-up of the Phase 3 concentrator to steady state was achieved early in the fourth quarter.

- Ivanhoe Mines’ Adjusted EBITDA was $160 million for Q3 2024, compared with $203 million for Q2 2024 and $152 million for the same period in 2023, which includes an attributable share of EBITDA from Kamoa-Kakula.

- Ivanhoe Mines has a strong balance sheet with cash and cash equivalents of $180 million on hand as at September 30, 2024, and expects that at current copper prices, cash flow generated from Kamoa-Kakula’s operations, as well as project-level financing facilities, will be sufficient to fund the remaining capital cost requirements for the Phase 3 expansion. Major capital cost requirements are expected to be reduced from the fourth quarter following completion of Kamoa-Kakula’s direct-to-blister smelter, with construction on track to be complete by year-end, and smelter ramp-up expected from Q1 2025.

OPERATIONAL HIGHLIGHTS

Positive results from drilling around Makoko and Makoko West led to the addition of three new, adjacent exploration licences, totaling 336 km2, to the Western Foreland package in Q3 2024. Two new rigs were also deployed to the newly acquired licence area after quarter-end.

Record quarterly production of 116,313 tonnes of copper in concentrate was achieved at Kamoa-Kakula for Q3 2024, compared with 86,203 tonnes in Q1 2024 and 100,812 tonnes in Q2 2024. Over the first nine months of 2024, Kamoa-Kakula produced a total of 303,328 tonnes of copper in concentrate.

Kamoa-Kakula’s 2024 production guidance has been revised to between 425,000 – 450,000 tonnes of copper due to the impact of power intermittency experienced, particularly in the first half of the year.

Kamoa-Kakula’s Phase 1 and 2 concentrators milled approximately 2.2 million tonnes of ore during the third quarter at an average feed grade of 4.9% copper. Copper flotation recoveries for the quarter averaged 86.6%.

Following the commissioning of the Phase 3 concentrator’s fine-grinding mills in September, sustained improvements in processing throughput and recovery rates were achieved.

During the third week of October, the concentrator milled a record 19,198 tonnes over 24 hours, equivalent to an annualized processing rate of over 6.5 million tonnes per annum, which is 30% higher than the nameplate capacity.

In addition, in late September, over 24 hours, the copper recovery rate of the concentrator averaged 87%, exceeding the nameplate recovery rate of 86%.

Kamoa-Kakula’s 500,000-tonne-per-annum on-site, direct-to-blister copper smelter is advancing on schedule with construction completion expected by the end of 2024, and heat-up to commence in Q1 2025.

During the quarter, DRA Global of Johannesburg, South Africa, and Zijin Engineering of Fujian Province, China were appointed as engineering, procurement, and construction management (EPCM) contractors to execute “Project 95” at Kamoa-Kakula.

A capital cost of approximately $200 million is estimated for concentrator modifications. Increased recovery to 95% is expected to boost average annualized copper production by up to 30,000 tonnes from the Phase 1 and 2 concentrators from Q1 2026.

The Kipushi concentrator ramp-up continued during the third quarter, producing 17,817 tonnes of zinc in concentrate. Nameplate concentrator milling rate is expected to be achieved in Q1 2025. Export of concentrates commenced at the end of Q3 2024.

Kipushi concentrator recovery rates regularly reached over 90% during the quarter. In addition, after quarter end, over 24 hours the Kipushi concentrator milled 2,108 tonnes, producing 1,357 tonnes of zinc concentrate at a concentrate grade of 52% contained zinc. This is equivalent to an annualized zinc production of approximately 220,000 tonnes of zinc, after accounting for availability.

Kipushi’s 2024 production guidance was revised to between 50,000 – 70,000 tonnes of zinc in concentrate based on the ramp-up schedule, from 100,000 – 140,000 tonnes previously.

Basic engineering has already commenced on de-bottlenecking initiatives of the Kipushi concentrator, to target a 20% increase in processing capacity to 960,000 tonnes of ore per annum. The de-bottlenecking program is expected to be complete in Q3 2025, based on the availability of long-lead order equipment.

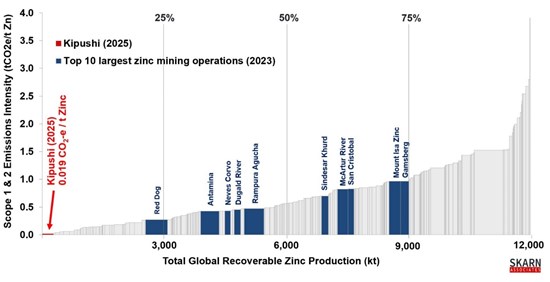

Kipushi will be the lowest greenhouse gas emitter per tonne of zinc produced. On a Scope 1 and 2 basis (reported from ore to mine gate), Kipushi’s greenhouse gas (GHG) emissions intensity for 2025 is expected to be 0.019 equivalent tonnes of carbon dioxide per tonne of contained zinc produced (t CO2-e / t Zn).

This comfortably ranks Kipushi at the bottom of the Scope 1 and 2 GHG emissions curve, according to independent industry experts Skarn Associates.

Construction of Platreef’s Phase 1 concentrator was completed on schedule early in the third quarter. Cold commissioning commenced, with water being fed through the concentrator.

The concentrator will be placed on care and maintenance until H2 2025, as Shaft #1 prioritizes the hoisting of waste from the development required to bring forward the start of Phase 2.

Reaming of the 5.1-meter diameter Shaft #3 from the 950-meter level was recently completed and equipping has commenced. Shaft #3 is expected to commence hoisting from Q1 2026 with a capacity of approximately 4 million tonnes per annum.

Work continues on the updated feasibility study to accelerate Platreef’s Phase 2, as well as the preliminary economic assessment of the new Phase 3 expansion. Both studies are expected to be published in Q1 2025.

Ivanhoe continues its expansive copper exploration program on its Western Foreland licenses adjacent to Kamoa-Kakula. Diamond drilling during the third quarter of 2024 focused on Makoko West, Kitoko, Sakanama, and Lubudi.

Nine drill rigs were in operation across the Western Foreland at quarter end, completing over 23,409 metres of diamond-core drilling, bringing the total to over 63,000 metres completed year-to-date, out of a total 70,000 metres planned.

For the third quarter, the group achieved an industry-leading combined Lost Time Injury Frequency Rate (LTIFR) of 0.50 and a Total Recordable Injury Frequency Rate (TRIFR) of 1.11 per 1,000,000 hours worked. Regrettably, there was one fatality in the group during the quarter, which occurred at Kamoa-Kakula.

Principal projects and review of activities

1. Kamoa-Kakula Copper Complex

39.6%-owned by Ivanhoe Mines

Democratic Republic of Congo

The Kamoa-Kakula Copper Complex is operated as the Kamoa Holding joint venture between Ivanhoe Mines and Zijin Mining. The project is approximately 25 kilometres southwest of the town of Kolwezi and about 270 kilometres west of Lubumbashi. Kamoa-Kakula’s Phase 1 concentrator began producing copper in May 2021.

The Phase 2 concentrator, completed in April 2022, doubled nameplate production capacity to 400,000 tonnes of copper per annum.

A debottlenecking program, completed 10 months later in February 2023, further increased copper production capacity to 450,000 tonnes per annum.

The Phase 3 concentrator completed in June 2024 expands annual production capacity up to approximately 600,000 tonnes of copper, ranking the Kamoa-Kakula Copper Complex as the world’s third-largest copper mining operation by international mining consultant Wood Mackenzie.

Ivanhoe sold a 49.5% share interest in Kamoa Holding Limited (Kamoa Holding) to Zijin Mining and a 1% share interest in Kamoa Holding to privately owned Crystal River in December 2015.

Kamoa Holding holds an 80% interest in the project and the DRC government holds the remaining 20% interest. Ivanhoe and Zijin Mining therefore each hold an indirect 39.6% interest in Kamoa-Kakula, with Crystal River holding an indirect 0.8% interest. Kamoa-Kakula’s full-time employee workforce is approximately 5,500 and is over 90% Congolese.

Kamoa-Kakula summary of operating and financial data

| Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 | |||||||||||||||

| Ore tonnes milled (000’s tonnes) | 3,266(1 | ) | 2,381(1 | ) | 2,061 | 2,133 | 2,236 | ||||||||||||

| Copper ore grade processed (%) | 4.14%(1 | ) | 4.91%(1 | ) | 4.80% | 4.95% | 5.37% | ||||||||||||

| Copper recovery (%) | 85.3%(1 | ) | 86.7%(1 | ) | 87.4% | 87.9% | 87.2% | ||||||||||||

| Copper in concentrate produced (tonnes) | 116,313 | 100,812 | 86,203 | 92,215 | 103,947 | ||||||||||||||

| Payable copper sold (tonnes)(2) | 103,106 | 95,900 | 85,155 | 90,967 | 96,509 | ||||||||||||||

| Cost of sales per pound ($ per lb.) | 1.80 | 1.53 | 1.50 | 1.50 | 1.34 | ||||||||||||||

| Cash cost (C1) ($ per lb.) | 1.69 | 1.52 | 1.57 | 1.53 | 1.46 | ||||||||||||||

| Realized copper price ($ per lb.) | 4.16 | 4.34 | 3.82 | 3.71 | 3.84 | ||||||||||||||

| Sales revenue before remeasurement ($’000) | 836,871 | 813,817 | 612,496 | 625,983 | 681,821 | ||||||||||||||

| Remeasurement of contract receivables ($’000) | (8,983 | ) | 3,256 | 5,824 | (8,365 | ) | 13,014 | ||||||||||||

| Sales revenue after remeasurement ($’000) | 827,888 | 817,073 | 618,320 | 617,618 | 694,835 | ||||||||||||||

| EBITDA ($’000) | 469,735 | 547,257 | 364,893 | 343,899 | 423,211 | ||||||||||||||

| EBITDA margin (% of sales revenue) | 57% | 67% | 59% | 56% | 61% | ||||||||||||||

All figures in the above tables are on a 100%-project basis. Metal reported in concentrate is before refining losses or deductions associated with smelter terms. This press release includes “EBITDA”, “Adjusted EBITDA”, “EBITDA margin”, and “Cash cost (C1)” which are non-GAAP financial performance measures. For a detailed description of each of the non-GAAP financial performance measures used herein and a detailed reconciliation to the most directly comparable measure under IFRS Accounting Standards, please refer to the non-GAAP Financial Performance Measures section of this press release. (1) Blended figures across the Phase 1, 2, and 3 concentrators, following the commencement of the Phase 3 concentrator in June 2024. Excluding Phase 3, the Phase 1 and 2 concentrators milled 2.21 million tonnes of ore at an average feed grade of 4.9% with an average recovery of 86.6% in Q3 2024.(2) Payable copper sold is net of the payability factor of circa 97%. Copper in concentrate produced net of the payability factor is noted in the non-GAAP Financial Performance Measures section of this press release. | |||||||||||||||||||

C1 cash cost per pound of payable copper produced can be further broken down as follows:

| Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 | ||

| Mining | ($ per lb.) | 0.62 | 0.45 | 0.44 | 0.38 | 0.41 |

| Processing | ($ per lb.) | 0.26 | 0.21 | 0.23 | 0.24 | 0.20 |

| Logistics charges | ($ per lb.) | 0.42 | 0.48 | 0.50 | 0.50 | 0.46 |

| TC, RC, smelter charges | ($ per lb.) | 0.26 | 0.25 | 0.25 | 0.26 | 0.25 |

| General & Administrative | ($ per lb.) | 0.13 | 0.13 | 0.15 | 0.15 | 0.14 |

| Cash cost (C1) per pound of payable copper produced | ($ per lb.) | 1.69 | 1.52 | 1.57 | 1.53 | 1.46 |

| Cash cost (C1) is prepared on a basis consistent with the industry standard definitions by Wood Mackenzie cost guidelines but are not measures recognized under IFRS Accounting Standards. In calculating the C1 cash cost, the costs are measured on the same basis as the company’s share of profit from the Kamoa Holding joint venture that is contained in the financial statements. C1 cash cost is used by management to evaluate operating performance and include all direct mining, processing, and general and administrative costs. Smelter charges and freight deductions on sales to the final port of destination, which are recognized as a component of sales revenues, are added to C1 cash cost to arrive at an approximate cost of delivered, finished metal. C1 cash cost excludes royalties, production taxes, and non-routine charges as they are not direct production costs.All figures are on a 100% project basis and metal reported in concentrate is before refining losses or deductions associated with smelter terms. | ||||||

Kamoa-Kakula’s Phase 1, 2, and 3 concentrators produced a record 116,313 tonnes of copper in concentrate in Q3 2024

Kamoa-Kakula produced 116,313 tonnes of copper in concentrate in the third quarter of 2024, including 94,214 tonnes of copper from the Phase 1 and 2 concentrators and 22,099 tonnes of copper from the Phase 3 concentrator. Over the first nine months of 2024, Kamoa-Kakula produced a total of 303,328 tonnes of copper in concentrate.

Kamoa-Kakula’s Phase 1 and 2 concentrators milled approximately 2.2 million tonnes of ore during the third quarter at an average feed grade of 4.9% copper.

Copper flotation recoveries for the quarter averaged 86.6%. Kamoa-Kakula’s Phase 3 concentrator, which produced first concentrate on June 10, 2024, continued its ramp-up to steady state production during the third quarter.

During the quarter, the Phase 3 concentrator milled approximately 1.1 million tonnes of ore at an average feed grade of 2.6% copper with an average flotation recovery rate of 79.9%.

Following the commissioning of the Phase 3 concentrator’s fine-grinding mills in September, sustained improvements in processing throughput and recovery rates were achieved.

During the third week of October, the concentrator milled a record 19,198 tonnes over a 24-hour period, which is equivalent to an annualized processing rate of over 6.5 million tonnes per annum, after accounting for availability.

This achievement is 30% higher than the nameplate capacity of the Phase 3 concentrator. In addition, in late September, over 24 hours the copper recovery rate of the concentrator averaged 87%, exceeding the nameplate recovery rate of 86%. Kamoa’s engineering team expects to consistently achieve, on an ongoing basis, the nameplate recovery rate of 86%.

Annual production guidance for Kamoa-Kakula has been revised to between 425,000 and 450,000 tonnes of copper in concentrate for 2024, compared with the original 2024 guidance of between 440,000 and 490,000 tonnes. 2024 cash cost (C1) guidance for Kamoa-Kakula remains unchanged.

The revised guidance reflects production loss due to intermittent grid power, in particular prior to the installation of additional on-site generator capacity, as well as imported power that now supports Kamoa-Kakula’s operations.

Approximately 36,000 tonnes of copper production are estimated to have been lost due to intermittent power over the first nine months of 2024, including 20,500 tonnes in the first quarter.

Guidance also considers the ramp-up rate of the newly constructed Phase 3 concentrator, which reached steady-state production after quarter-end.

Kamoa Copper continues to work closely with the DRC’s state-owned power company, La Société Nationale d’Electricité (SNEL), to deliver solutions for the identified causes of instability experienced across the southern DRC’s grid infrastructure since late 2022.

The project work, which is budgeted up to $200 million and funded by Kamoa Holding, commenced in late Q1 2024 and is expected to be completed by the end of 2025. The funding is assigned to increasing transmission capacity and improving the reliability of the grid.

The project consists of grid infrastructure upgrades, such as an increase in grid capacity between the Inga II dam and Kolwezi, a new harmonic filter at the Inga Converter Station, as well as a new static compensator at the Kolwezi Converter Substation.

In addition, various smaller initiatives have been identified to strengthen the transmission capability and improve the long-term stability of the southern grid.

This includes the restringing of powerlines in the southern grid and repairs to the direct current (DC) infrastructure. In addition to this, Ivanhoe Mines Energy DRC is working with SNEL to put in place maintenance contracts to maintain key generation capacity and transmission infrastructure.

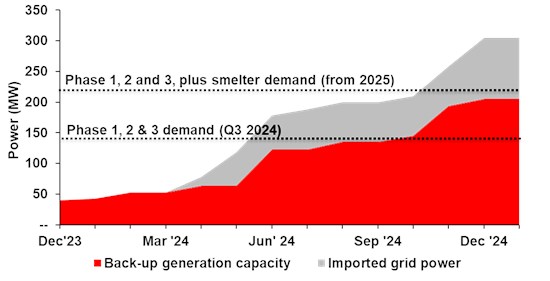

Imported power during the quarter increased to 65 megawatts (MW), negotiations are underway to increase imported power to over 100 MW; 205 MW onsite back up power targeted by year-end

In the third quarter, grid-supplied power to Kamoa-Kakula continued to be supplemented with imported power via the Zambian interconnector.

In July, secured imported power increased to 65 MW, with 10 MW sourced from generation capacity in Zambia and 55 MW sourced from Mozambique via the Southern Africa Power Pool network.

Negotiations are well advanced to increase imported power to over 100 MW by year-end, increasing to 200 MW in the medium to long term.

Kamoa Copper’s engineering team continues to expand its on-site backup generation capacity to ensure sufficient redundancy for the current Phase 1, 2, and 3 operations.

The total installed on-site, backup power generation capacity is currently 145 MW, following the delivery and commissioning of an additional 72 MW of generators during the quarter and a further 10 MW in October.

The on-site backup power capacity is sufficient to power Kamoa-Kakula’s Phase 1 and 2 concentrators at full capacity in the event of intermittent power.

Kamoa’s project team remains on schedule to install a further 60 MW of on-site backup power generation capacity by year-end.

Figure 1. Kamoa-Kakula’s power demand profile versus the projected phased rollout of on-site, back-up generation capacity and imported grid power, supplementing existing domestically-sourced power from SNEL (MW).

Refurbishment of Turbine #5 at Inga II approximately 75% complete

Refurbishment works of Turbine #5 at the Inga II hydroelectric facility are approximately 75% complete and advancing within budget to generate 178 MW of hydroelectric power for the DRC electrical grid from Q1 2025.

Following the late delivery of the turbine runner and shaft in the first quarter of 2024, wet commissioning and synchronization with the grid is scheduled for Q1 2025.

All critical-path equipment, including alternator and transformers, have been delivered to site, and assembly works are well advanced, with the alignment of the alternator’s stator and rotor nearing completion.

Ramp-up of the Phase 3 concentrator to steady-state completed early in fourth quarter; commissioning of underground infrastructure in the Kamoa 1 mine to improve mining costs

First ore to Kamoa-Kakula’s Phase 3 concentrator was achieved on May 26, 2024, up to two quarters ahead of the originally announced schedule, with first concentrate reported on June 10, 2024.

The new 5-million-tonne-per-annum (Mtpa) Phase 3 concentrator is located adjacent to the Kamoa 1 and 2 underground mines, approximately 10 kilometres north of the Phase 1 and 2 concentrators located above the Kakula underground mine. Ramp-up to steady-state production of the Phase 3 concentrator was completed early in the fourth quarter.

The Phase 3 concentrator is 30% larger in capacity, compared with the Phase 1 and 2 concentrators. The process design is very similar, therefore the bulk of the equipment is the same as or similar to that installed in the Phase 1 and 2 concentrators, resulting in a commonality of spare parts, while also leveraging prior operational and maintenance experience.

Construction of underground infrastructure at the Kamoa 1, Kamoa 2 and the Kansoko mines continued during the quarter and into the fourth quarter.

Construction of the Kamoa 1 underground-to-surface ore conveyor system, similar in design to Kakula, and first truck tip are nearing completion and are expected to be commissioned imminently.

Until this ore handling system is operational, ore from underground will continue to be hauled to surface by truck. Mining costs are expected to improve once the truck tip and conveyor are commissioned as notable efficiencies will be gained from this new infrastructure. A second truck-tip is under construction and is expected to be commissioned at the end of Q2 2025.

Concurrently, underground development at Kamoa 1 and 2 continues to focus on opening-up access to ore reserves well in advance of the mine plan. Kamoa-Kakula’s mining engineering team are targeting to have completed enough underground development for 18 months of accessible mining reserves by the end of 2025.

This provides the mine with flexibility to achieve a consistent head grade from the higher- and lower-grade mining areas. A similar strategy has also been employed at the Kakula underground mine.

During the third quarter, approximately 40% of the Phase 3 concentrator’s feed was from surface stockpiles. The Phase 3 concentrator will continue to process surface stockpiles during the fourth quarter, increasingly supplemented with development ore from the Kamoa 1 and 2 underground mines as the underground-to-surface ore conveyor system is commissioned. Therefore, the team is targeting an increase in the feed grade to the Phase 3 concentrator to between 2.8% and 3% copper during Q1 2025.

As of September 30, 2024, a total of 4.57 million tonnes of ore at an average grade of 3.11% copper is stored in multiple surface run-of-mine (ROM) stockpiles across the Kamoa-Kakula Copper Complex.

This includes 2.24 million tonnes of ore at an average grade of 3.62% at Kakula and 2.32 million tonnes of ore at an average feed grade of 2.61% at Kamoa and Kansoko.

Sale of copper concentrates produced by the Phase 3 concentrator commenced early in the third quarter. Concentrate produced from Phase 3 is being toll-treated into blister copper at the Lualaba Copper Smelter (LCS) to maximize profitability until the on-site smelter is completed.

As such, total inventory, including in the on-site warehouse and at LCS, increased to approximately 16,000 tonnes of copper in concentrate at the end of the quarter. LCS is located approximately 50 kilometres from Kamoa-Kakula, near the town of Kolwezi.

It is expected that from early in Q1 2025, 20,000 to 30,000 tonnes of copper in concentrate produced by the Phase 3 concentrator will start to be stockpiled on-site in anticipation of the heat-up and ramp-up of the on-site smelter from Q1 2025. Once fully ramped-up the smelter is expected to maintain approximately 17,000 tonnes of copper within the circuit.

Direct-to-blister copper smelter project is 94% complete and on schedule for construction completion by the end of 2024

Kamoa-Kakula is building Africa’s largest smelter, which will have a capacity of 500,000 tonnes of >99%-pure blister-anode copper per annum.

The direct-to-blister flash smelter is under construction adjacent to the existing Phase 1 and Phase 2 concentrator plants. The smelter incorporates leading-edge technology supplied by Metso Finland and will comply with the world-leading International Finance Corporation’s (IFC) emissions standards.

The smelter project is 94% complete and is on schedule for construction completion by the end of 2024. Equipment delivery is nearing completion, with the only major outstanding delivery being the slag ladles.

Installation of mechanical equipment and piping is nearing completion. The refractory installation for the electric slag-cleaning furnace is complete and the refractory installation for the direct-to-blister furnace has begun.

Electrical installation is well advanced in all areas and some early commissioning activities for power and water reticulation commenced during the third quarter.

Furnace heat-up is expected to commence in Q1 2025, with Kamoa-Kakula’s smelter team targeting a ramp-up to 75% capacity in Q3 2025, reaching 90% in the fourth quarter of 2025, subject to concentrate blend.

Recruitment of the 970-personnel operating team is nearing completion, with management and technical training well underway.

250 of the newly recruited workforce have been temporarily deployed to similar copper smelters in China and Zambia to gain operational experience, ahead of commencing smelter commissioning activities at Kamoa-Kakula in the coming months.

The smelter will have a processing capacity of approximately 1.2 Mtpa of dry concentrate feed and is designed to run on a blend of concentrate produced from the Kakula (Phase 1 and 2) and Kamoa (Phase 3 and future Phase 4) concentrators.

Where possible, Kamoa-Kakula will continue to toll-treat concentrates domestically, with surplus concentrates smelted at LCS.

As a by-product, the smelter will also produce 600,000 to 700,000 tonnes per year of high-strength sulphuric acid, depending on the sulphur content of the feed concentrate.

There is a strong demand for sulphuric acid in the DRC, as it is used to leach copper from oxide ores through the SX-EW (solvent extraction and electrowinning) process.

Offtake contracts for the high-strength sulphuric acid produced by the smelter are well-advanced with purchasers local to the Kolwezi area.

The on-site smelter will offer transformative financial benefits for the Kamoa-Kakula Copper Complex, most significantly a material reduction in logistics costs, and to a lesser extent reduced concentrate treatment charges and local taxes, as well as revenue from acid sales.

Logistics costs accounted for approximately 30% of Kamoa-Kakula’s total cash cost (C1) during 2024 to date, and the volume of required trucks is expected to approximately halve following the smelter start-up as each truck will transport 99+%-pure blister copper anodes instead of wet concentrate with 40-50% contained copper.

Project 95 to unlock up to 30,000 tonnes per annum of additional copper growth from Phase 1 and 2 concentrators from 2026

Project 95 aims to improve copper recovery rates of the Phase 1 and 2 concentrators from 87% to 95%, unlocking up to 30,000 tonnes per annum of additional copper production.

The Project 95 scope of work consists of modifications to the Phase 1 and 2 concentrators as shown below, as well as the construction of a new cell at the tailings storage facility.

The modifications to the existing Phase 1 and 2 concentrators consist of a new coarse-fine cyclone bank, flash flotation cells, coarse rougher tailings tank, additional feed tanks to the rougher scavenger and cleaner scavenger flotation cells, and new cleaner flotation cells.

In addition, a new fine-regrind milling plant adjacent to the Phase 1 and Phase 2 concentrator plants will be constructed, with high-intensity grinding (HIG) mills, rougher tailings cyclones, and slime thickeners.

Following the completion of Project 95, the copper grade of the tailings stream from the Phase 1 and 2 concentrators will be significantly reduced from approximately 0.7% to 0.2% copper.

To avoid sterilizing the higher-grade tailings currently in Cell 1, tailings from Project 95 will be placed into a separate cell within the tailings storage facility, Cell 2.

The construction of Cell 2, originally intended to take place during the future Phase 4 expansion, will be brought forward to separate the existing high-grade tailings from the new lower-grade tailings produced by Project 95.

The construction of Cell 2 is expected to cost approximately $82 million and be constructed in parallel with the Project 95 concentrator modifications. Geotechnical work has already commenced on Cell 2, which will be a downstream-tailings design and comply with the Global Industry Standard on Tailings Management (GISTM).

Delivery of Project 95 underway, with completion targeted for Q1 2026

During the quarter, DRA Global of Johannesburg, South Africa and Zijin Engineering of Fujian Province, China were appointed as engineering, procurement and construction management (EPCM) contractors to execute Project 95. DRA Global was the EPCM contractor that delivered ahead-of-schedule the Phase 1, 2 and 3 concentrators at Kamoa-Kakula.

The construction of Project 95 is expected to take approximately 18 months with completion targeted during the first quarter of 2026. Engineering design and procurement of long-lead order equipment items are well underway. Geotechnical engineering has also commenced on Cell 2.

The estimated capital cost for the modifications to the Phase 1 and 2 concentrator plants is approximately $180 million, including contingency.

Therefore, the brownfield expansion project is expected to have a capital intensity of approximately $6,000 per tonne of copper produced.

For context, according to BofA Securities research, dated July 12, 2024, the average capital intensity for greenfield copper projects and brownfield expansions is $20,000 per tonne of copper and $17,500 per tonne of copper, respectively.

Project 95’s incremental operating costs are estimated to be approximately $4 per tonne milled.

2025 Integrated Development Plan to include future growth initiatives such as Project 95, Phase 3 debottlenecking, and Phase 4 expansion

Following the last Integrated Development Plan, released on January 30, 2023, Kamoa’s engineering team is working on an updated 2025 Integrated Development Plan (2025 IDP).

The 2025 IDP will include initiatives targeting increased processing recoveries and processing throughput from the Phase 1, 2, and 3 concentrators, as well as a new Phase 4 expansion.

Kamoa’s engineering team is targeting to increase recovery rates of the Phase 1 and 2 concentrators and the Phase 3 concentrator, from the current nameplate rates of 87% and 86%, up to 95% and 92%, respectively, including Project 95.

In addition, the processing capacity of the existing Phase 1, 2 and 3 operations is targeted to be boosted by up to 20%, from 14.2 Mtpa to 17 Mtpa.

The Phase 4 expansion involves doubling the size of the milling and flotation circuit adjacent to Phase 3. Like the Phase 2 expansion with Phase 1, the front-end crushing circuit installed for Phase 3 has already been oversized to accommodate Phase 4.

Phase 4 will be fed by ramping up new mining areas on the Kamoa-Kakula complex, timing of which is under study for the 2025 IDP.

COPPER PRODUCTION AND CASH COST GUIDANCE FOR 2024

| Kamoa-Kakula 2024 Guidance | ||

| Previous guidance | 440,000 to 490,000 | Contained copper in concentrate (tonnes) |

| Revised guidance | 425,000 to 450,000 | Contained copper in concentrate (tonnes) |

| Unchanged cash cost (C1) | 1.50 to 1.70 | $ per pound |

Revised full-year production guidance reflects production lost due to intermittent grid power, in particular prior to the installation of additional on-site generator capacity and agreements to import power to support power consumption from the DRC grid.

Approximately, 36,000 tonnes of copper production are estimated to have been lost due to intermittent power over the first nine months of 2024, including 20,500 tonnes in the first quarter.

Guidance also considers the commissioning of the Phase 3 concentrator, which reached steady-state early in the fourth quarter.

Guidance figures are on a 100% project basis and metal reported in concentrate is before refining losses or deductions associated with smelter terms.

Kamoa-Kakula’s 2024 guidance is based on several assumptions and estimates and involves estimates of known and unknown risks, uncertainties and other factors that may cause the actual results to differ materially.

The Kamoa-Kakula joint venture produced a total of 116,313 tonnes of copper in concentrate for the three months ended September 30, 2024, and 303,328 tonnes of copper for the nine months ended September 30, 2024.

Cash cost (C1) per pound of payable copper produced amounted to $1.69/lb. for the three months ended September 30, 2024, and $1.60/lb. for the nine months ended September 30, 2024.

The increase in cash costs (C1) during the quarter was predominantly due to comparatively lower feed grades into the Phase 3 concentrator since first production in June, as well as the increased use of on-site, backup power.

Cash cost guidance is based on assumptions including feed grades of processed copper ore, the ramp-up of the Phase 3 concentrator, reliability of DRC grid power supply, the availability and cost of alternative sources of electricity supply, and prevailing logistics rates among other variables.

Cash cost guidance is impacted by the timing of the ramp-up to steady-state of Kamoa-Kakula’s Phase 3 concentrator. Copper in concentrate produced by the Phase 3 concentrator is expected to have a higher cash cost, compared with that of the Phase 1 and Phase 2 concentrators.

This is primarily due to the lower copper grade of the stockpiles feeding the Phase 3 concentrator, compared with the higher-grade ore from the Kakula Mine that feeds the Phase 1 and Phase 2 concentrators.

Cash cost (C1) is a non-GAAP measure used by management to evaluate operating performance and includes all direct mining, processing, stockpile rehandling charges, and general and administrative costs.

Smelter charges and freight deductions on sales to the final port of destination (typically China), which are recognized as a component of sales revenues, are added to cash cost (C1) to arrive at an approximate cost of delivered finished metal. For historical comparatives, see the non-GAAP Financial Performance Measures section of this press release.

2. Kipushi Project

68%-owned by Ivanhoe Mines

Democratic Republic of Congo

The historic Kipushi zinc-copper-germanium-silver mine in the DRC is adjacent to the town of Kipushi, approximately 30 kilometres southwest of Lubumbashi on the Central African Copperbelt.

Kipushi is approximately 250 kilometres southeast of the Kamoa-Kakula Copper Complex and less than one kilometre from the Zambian border.

Ivanhoe acquired its 68% interest in the Kipushi Mine in November 2011, through Kipushi Holding which is 100%-owned by Ivanhoe Mines.

The balance of 32% in the Kipushi Mine is held by the DRC state-owned mining company, Gécamines. As per the updated joint venture agreement signed in late 2023, Gécamines’ ownership is set to increase to 38% upon completion of outstanding conditions precedent.

For over 69 years up until 1993 when the mine was placed on care and maintenance, the Kipushi Mine produced a total of 6.6 million tonnes of zinc and 4.0 million tonnes of copper from 60 million tonnes of ore grading 11% zinc and approximately 7% copper.

It also produced 278 tonnes of germanium and 12,673 tonnes of lead between 1956 and 1978. There is no formal record of the production of precious metals as the concentrate was shipped to Belgium and the recovery of precious metals remained undisclosed during the colonial era; however, drilling by Ivanhoe Mines has encountered significant silver values within Kipushi’s current zinc- and copper-rich deposits.

Since acquiring its interest in Kipushi in 2011, Ivanhoe’s drilling campaigns have upgraded and expanded the mine’s zinc-rich Big Zinc and Southern Zinc orebodies to a Measured and Indicated Mineral Resource of 11.78 million tonnes grading 35.34% zinc, 0.80% copper, 23 grams/tonne (g/t) silver and 64 g/t germanium, at a 7% zinc cut-off, containing 9.2 billion pounds of zinc, 8.7 million ounces of silver and 24.4 million ounces of germanium.

Kipushi’s exceptional zinc grade is more than twice that of the world’s next highest-grade zinc project, according to Wood Mackenzie, a leading, international industry research and consulting group.

Kipushi’s high-grade zinc concentrate assays include significant quantities of germanium and gallium. Germanium is a strategic metal used today in electronic devices, flat-panel display screens, light-emitting diodes, night vision devices, optical fibre, optical lens systems, and solar power arrays.

Gallium is a strategic metal used today to manufacture compound semiconductor wafers used in integrated circuits, and optoelectronic devices such as laser diodes, light-emitting diodes, photodetectors, and solar cells.

Kipushi concentrator continues ramp-up during the third quarter, producing 17,817 tonnes of zinc in concentrate

Construction of the new 800,000-tonne-per-annum concentrator facility was completed months ahead of schedule on May 31, 2024, following the first feed of ore.

The concentrator process consists of dense media separation (DMS) and a milling and flotation circuit. Design recoveries are targeted to be 96% with a concentrate grade averaging up to 55% contained zinc.

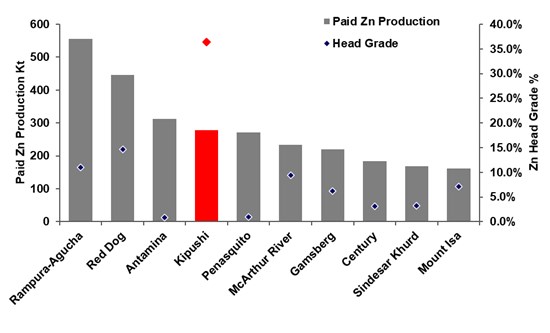

As per the Kipushi 2022 Feasibility Study, released on February 14, 2022, over the first five years annualized production is expected to average 278,000 tonnes of zinc in concentrate, positioning Kipushi as the world’s fourth-largest zinc mine and the largest on the African continent. See Figure 2.

Commissioning of the Kipushi concentrator commenced in early May, with first feed of ore from the surface ROM stockpiles fed through the ball mill during the evening of May 31, 2024.

Following first concentrate production on June 14, 2024, ramp-up of Kipushi’s concentrator continued during the third quarter. Kipushi’s concentrator milled approximately 88,000 tonnes of ore during the third quarter at an average feed grade of 27.1% zinc.

Quarterly zinc production from the concentrator was 17,817 tonnes, at an average flotation recovery rate of 72.0%. Exports of zinc concentrate also commenced towards the end of the quarter.

Ramp up of Kipushi’s concentrator has been slower than anticipated as a result of three principal factors: first, ore mined and stockpiled from the top of the Big Zinc orebody has a relatively high iron content, which was negatively impacting concentrator recoveries prior to reagent adjustments; second, ore feed into the DMS circuit contains a higher-than-expected proportion of fine material (“fines”), which is limiting throughput; and third, the increase in power requirement, from 5 MW used during construction to 18 MW for operations, has exposed transmission bottlenecks in the local grid infrastructure.

Figure 2. World’s top 10 zinc mines estimated for 2025, by paid zinc production per annum (‘000 tonnes) with head grade (% zinc).

Source: Wood Mackenzie, 2024, Ivanhoe Mines. Production and grade assumptions for Kipushi are the first five-year average as stated in the 2022 Feasibility Study.

During the latter part of September and into October, the Kipushi concentrator regularly operated close to its nameplate throughput of over 80 tonnes per hour (800,000 tonnes per annum).

Over a 24-hour period after quarter-end, the Kipushi concentrator milled 2,108 tonnes of ore, producing 1,357 tonnes of zinc concentrate at a concentrate grade of 52% contained zinc.

This is equivalent to an annualized zinc production of approximately 220,000 tonnes of zinc, after accounting for availability. However, the operational disruptions have inhibited the nameplate throughput from being sustained on a consistent basis.

While the Kipushi concentrator’s metallurgical recoveries improved to over 90% in the latter half of September, targeting a design rate of approximately 95%, a work program is underway to separate the ore fines upstream of the DMS, as well as conduct electrical upgrades to improve the synchronisation with the grid.

The Kipushi concentrator’s nameplate milling rate is expected to be achieved in Q1 2025. As a result, the full-year production guidance range for Kipushi has been reduced from 100,000 – 140,000 tonnes of zinc in concentrate, to 50,000 – 70,000 tonnes of zinc in concentrate.

Engineering and procurement of long-lead order equipment items are well underway for the Kipushi debottlenecking program. The debottlenecking of the Kipushi concentrator is targeting a 20% increase in concentrator processing capacity to 960,000 tonnes of ore per annum.

The debottlenecking program is expected to be completed in Q3 2025. There is sufficient capacity to increase mining and hoisting rates to sustainably support this increased concentrator throughput.

Run-of-mine stockpiles to support ramp-up to steady-state production, with underground development advancing ahead of schedule

As of September 30, 2024, a total of 360,000 tonnes of ore at an average grade of 23% zinc is stored in surface ROM stockpiles adjacent to the Kipushi concentrator. This includes a high-grade section of 150,000 tonnes of ore at an average grade of 30% zinc.

Underground development continues to progress ahead of schedule. Year to date, over 3,000 metres of underground development have been completed, approximately 100 metres ahead of schedule.

Greenhouse Gas emissions assessment confirms that Kipushi will be lowest carbon emitter per unit of zinc production in the world

Kipushi will be the lowest greenhouse gas emitter per tonne of zinc produced. On a Scope 1 and 2 basis (reported from ore to mine gate), Kipushi’s greenhouse gas (GHG) emissions intensity for 2025 is expected to be 0.019 equivalent tonnes of carbon dioxide per tonne of contained zinc produced (t CO2-e / t Zn). This comfortably ranks Kipushi near the bottom of the Scope 1 and 2 GHG emissions curve, as shown in Figure 3.

This is partially due to the ultra-high-grade Big Zinc orebody, which has an average head grade of over 36% zinc over the first five years of operation.

The Kipushi head grade is more than 6.5 times higher than the average head grade of the top 20 zinc mining operations in 2023. A high head grade means significantly less rock is mined, hauled and milled for the same tonne of zinc produced. The total peak power required by the mining and milling operation is only 23 MW.

The low carbon emissions intensity is also a function of the DRC grid being among the world’s cleanest, with 99.5% of grid power generated from hydroelectricity, according to the U.S. Energy Information Administration.

Figure 3. 2023 Scope 1 & 2 zinc GHG emissions intensity curve, highlighting Kipushi and the top 10 largest zinc mining operations in 2023.

Notes: Kipushi and industry peer Scope 1 and 2 GHG emissions data are estimates by Skarn Associates. Estimates include all direct and indirect emissions to produce contained zinc from ore to mine gate.

The horizontal width of each bar represents the quantity of each operation’s 2023 zinc production in ‘000 tonnes. 2025 Kipushi production is estimated to be 278,000 tonnes of payable zinc in concentrate, based on the 2022 feasibility study.

2025 zinc production is not forward guidance. It is estimated that operations will emit a total of 5,047 equivalent tonnes of CO2, thereby producing 0.019 equivalent tonnes of CO2 per tonne of zinc produced. Chart sources: Skarn Associates, Ivanhoe Mines.

ZINC PRODUCTION AND CASH COST GUIDANCE FOR 2024

| Kipushi 2024 Guidance | ||

| Previous guidance | 100,000 to 140,000 | Contained zinc in concentrate (tonnes) |

| Revised guidance | 50,000 to 70,000 | Contained zinc in concentrate (tonnes) |

Revised full year production guidance reflects production lost due to slower than expected ramp-up of the Kipushi concentrator, due to metallurgical challenges and intermittent grid power.

Guidance figures are on a 100% project basis and metal reported in concentrate is before treatment losses or payability deductions associated with smelter terms.

Kipushi’s 2024 production guidance is based on several assumptions and estimates, including among other things, assumptions about the timing of ramp-up of the new 800,000-tonne-per-annum Kipushi concentrator.

Guidance involves estimates of known and unknown risks, uncertainties and other factors that may cause the actual results to differ materially.

3. Platreef Project

64%-owned by Ivanhoe Mines

South Africa

The Platreef Project is owned by Ivanplats (Pty) Ltd. (Ivanplats), which is 64%-owned by Ivanhoe Mines. A 26% interest is held by Ivanplats’ historically disadvantaged, broad-based, black economic empowerment (B-BBEE) partners, which include 20 local host communities with approximately 150,000 people, project employees and local entrepreneurs.

A Japanese consortium of ITOCHU Corporation, Japan Oil, Gas and Metals National Corporation (JOGMEC), and Japan Gas Corporation, owns a 10% interest in Ivanplats, which it acquired in two tranches for a total investment of $290 million.

The Platreef Project hosts an underground deposit of thick, platinum-group metals, nickel, copper, and gold mineralization on the Northern Limb of the Bushveld Igneous Complex in Limpopo Province – approximately 280 kilometres northeast of Johannesburg and eight kilometres from the town of Mokopane in South Africa.

On the Northern Limb, platinum-group metals mineralization is primarily hosted within the Platreef, a mineralized sequence traced for more than 30 kilometres along strike.

Ivanhoe’s Platreef Project, within the Platreef’s southern sector, is comprised of two contiguous properties: Turfspruit and Macalacaskop.

Turfspruit, the northernmost property, is contiguous with, and along strike from, Anglo Platinum’s Mogalakwena group of mining operations and properties.

Since 2007, Ivanhoe has focused its exploration and development activities on defining and advancing the down-dip extension of its original discovery at Platreef, now known as the Flatreef Deposit, which is amenable to highly mechanized, underground mining methods.

Cold commissioning of the Phase 1 concentrator completed early in Q3; first ore scheduled for H2 2025 while underground development prioritizes waste development to accelerate the start of Phase 2

Construction of Platreef’s Phase 1 concentrator was completed on schedule early in the third quarter. Cold commissioning started in July, with water being fed through the concentrator.

The concentrator will be kept on care and maintenance until H2 2025, as Shaft #1 prioritizes the hoisting of waste development required to bring forward the start of Phase 2.

Updated feasibility study for optimized Platreef Phase 2 and PEA for new Phase 3 expected in Q1 2025, ranking Platreef as one of the world’s largest PGM producers

In 2023, Ivanhoe’s engineering team completed an internal optimization study of the phased expansion of the Platreef Project. Current underground development and operations are dependent on the initial 1-Mtpa Shaft #1 until the 10-metre-diameter, 8-Mtpa Shaft #2 is commissioned. The study concluded that accelerating the startup of Phase 2 will create significant project value.

Following the completion of the optimization study, DRA Global of Johannesburg, South Africa, were appointed to update the Platreef 2022 Feasibility Study for the optimized and accelerated Phase 2 expansion. Study work is nearing completion, with results expected to be released in the first quarter of 2025.

In parallel with the release of the updated Phase 2 feasibility study, Ivanhoe also commissioned a preliminary economic assessment (PEA) for an additional expansion, Phase 3, taking the total Platreef processing capacity up to approximately 10 Mtpa.

The new Phase 3 expansion is expected to consist of two additional 3.3-Mtpa concentrator modules, to be located adjacent to the Phase 1 and 2 concentrators.

Phase 3 is anticipated to rank Platreef as one of the world’s largest and lowest-cost platinum-group metal, nickel, copper and gold producers.

The 10-Mtpa concentrator capacity of the Phase 3 expansion will be 12.5 times greater than that of Phase 1 and 2.5 times greater than the processing capacity of the optimized Phase 2 expansion.

The results of the Phase 3 PEA will be released at the same time as the updated feasibility study for Phase 2.

Reaming of Shaft #3 from 950 metres recently completed; Phase 2 expansion based on additional hoisting capacity from Shaft #3

The Phase 2 expansion will be accelerated by re-purposing ventilation Shaft #3 for hoisting. Shaft #3 will generate additional hoisting capacity of approximately 4 Mtpa, bringing the total hoisting capacity to approximately 5 Mtpa.

The reaming of Shaft #3, to a diameter of 5.1-metre down, has recently been completed. Reaming is the process of boring, or excavating, a vertical shaft from the bottom up and it is the quickest and safest method of constructing a shaft.

Once equipped, Shaft #3 is expected to be ready for hoisting in the first quarter of 2026, well ahead of the completion of the much larger Shaft #2.

The internal study concluded that equipping Shaft #3 for hoisting de-risks Phase 1 underground operations ahead of the completion of Shaft #2 and accelerates the underground development for Phase 2.

In addition, the Phase 2 concentrator would have an increased processing capacity of 3.3 Mtpa, up from 2.2 Mtpa as per the first module of Phase 2 defined in the Platreef 2022 Feasibility Study.

Therefore, the Phase 1 and Phase 2 concentrators will have a total combined processing capacity of approximately 4 Mtpa, with ore fed by Shaft #1 and Shaft #3.

Additional underground ventilation will now be provided by two new 5.1-metre-diameter shafts, named Shaft #4 and Shaft #5. Drilling of the pilot hole for Shaft #4 is complete, with reaming expected to start imminently.

Civil construction of Shaft #4’s substation building and ventilation fans are advancing well. Geotechnical drilling has commenced on the proposed Shaft #5 site.

Platreef’s Shaft #2 head gear (centre) with the base and structural steel of Shaft #3’s Rock Winder in the foreground.

The installation of the 1,124 tonnes of internal structural steel inside Shaft #2’s head frame continued during the quarter, as well as the installation of the Sinking Winders and related infrastructure.

Reaming of Shaft #2 to an initial diameter of 3.1 metres is progressing well with approximately 100 metres remaining and completion expected in the coming weeks.

Expansion of the shaft to its final diameter of 10 metres will commence in late 2025. The completion of Shaft #2 will increase the total hoisting capacity for ore and waste development, across all three shafts to over 12 Mtpa.

Construction of Platreef’s first 5-MW solar power facility is expected to be complete by year-end. The power generated by the plant will support development activities and operations, together with other renewable energy sources that are expected to be introduced over time.

4. Western Forelands Exploration Project

60%- to 100%-owned by Ivanhoe Mines

Democratic Republic of Congo

Ivanhoe’s DRC exploration group is targeting Kamoa-Kakula-style copper mineralization on its Western Forelands exploration licences.

More recent discoveries at Makoko, Makoko West, Kiala and Kitoko, confirm the effectiveness of these models and the understanding of controls on this highly valuable and unique style of mineralization.

Diamond drilling during the third quarter of 2024 was focused on Makoko West, Kitoko, Sakanama and Lubudi. Nine contractor rigs were in operation across the Western Foreland at quarter end, having completed a total of 25,509 metres of diamond core over 34 drill holes.

Ivanhoe is well on track to complete the stated total of 70,200 metres of diamond drilling for the year, with over 63,000 metres of diamond drilling complete through the first nine months of 2024.

Reverse Circulation (RC) drilling through the Kalahari sand cover at Kamili has progressed well during the quarter, with a total of 343 holes completed totaling 6,719 metres of drilling.

Drilling at Makoko West (southwest of the original Makoko mineral resource, as announced on November 13, 2023) continued in the third quarter with a total of 12,487 metres were drilled across 18 completed holes.

Positive results from the ongoing drilling around the Makoko area, and more recently the highly prospective “Makoko West” target, led to the acquisition of three adjacent exploration licences, covering an area of 336 km2.

Exploration activities on the newly acquired licences commenced at the beginning of the fourth quarter. A new drilling contractor has been appointed and two rigs have been mobilized for a 32,000-metre drilling program.

This is in addition to the nine drill rigs currently deployed across the Western Forelands, of which six are focused on Makoko, Makoko West and Kitoko..

Drilling activity at Kitoko continues to test the extent of the system, and to understand the controls on mineralization. A total of 5,965 metres were drilled during the quarter across 8 holes.

Drilling activity at Kitoko continues to test the extent of the system, and to understand the controls on mineralization. A total of 5,965 metres were drilled during the quarter across 8 holes.

With the third quarter falling within the middle of the dry season, access to the more remote areas of the Western Forelands land package greatly improved.

Therefore, targets such as Sakanama and Lubudi on the outer edges of the licence package were drilled during the quarter, with a total of 4,794 metres drilled across six holes.

Stratigraphic drilling continued in the Lubudi region to the south of Makoko during the quarter with four wide-spaced diamond drillholes totalling 2,263 metres completed.

A proof-of-concept passive seismic program commenced at Kitoko in the third quarter, testing the technology’s ability to image key Katangan geological horizons below thick Kalahari sand which blankets prospective geological formations.

Learnings from this program will be applied elsewhere on the Western Foreland and on Ivanhoe’s Angolan Project where thick Kalahari sands are also present.

Planning is underway for another major drill campaign across the Western Forelands in 2025, details of which will be released before year-end.

5. The Mokopane Feeder Exploration Project

100%-owned by Ivanhoe Mines

South Africa

Three new 100%-owned exploration rights were granted on the Northern Limb of the Bushveld complex in South Africa during Q4 2022. The three new exploration rights (Blinkwater 244KR, Moordrift 289KR and Lisbon 288KR) cover 80-km2 forming a continuous block situated on the southwest border of the existing Platreef Project’s mining rights.

A gravity-high anomaly based on wide-spaced historical Council for Geoscience data was interpreted to represent a primary feeder zone to the Rustenburg Layered Suite of the Northern Limb of the Bushveld Complex.

The working hypothesis for this large gravity anomaly (the Mokopane Feeder) is that it represents a significant thickening of the Rustenburg Layered Suite, particularly of the denser Lower Zone units associated with regional scale crustal faults, with significant potential for nickel, copper and platinum-group metals mineralization.

Detailed high-resolution fixed-wing airborne magnetic and Falcon airborne gravity gradiometer geophysical surveys were completed in 2023 to map the subsurface petrophysical characteristics of the anomaly.

The collection, interpretation and review process of all geological and geophysical data was completed earlier in the year. The geological understanding of the anomaly continues to evolve, with three targets identified for drilling.

Diamond drilling contractor, Geosearch, has been appointed and is expected to soon commence drilling following the completion of the stakeholder engagement and heritage survey. Drilling is expected to continue until the second quarter 2025. Downhole geophysics will be conducted concurrently with drilling.

SELECTED QUARTERLY FINANCIAL INFORMATION

The following table summarizes selected financial information for the prior eight quarters. Ivanhoe had no operating revenue in any prior financial reporting period.

Revenue from commercial production at the Kipushi Mine will commence in Q4 2024. All revenue from production at Kamoa-Kakula is recognized within the Kamoa Holding joint venture. Ivanhoe did not declare or pay any dividend or distribution in any financial reporting period.

| Three months ended | ||||||||||||

| September | June | March | December | |||||||||

| 2024 | 2024 | 2024 | 2023 | |||||||||

| $’000 | $’000 | $’000 | $’000 | |||||||||

| Share of profit from joint venture | 83,507 | 89,616 | 45,165 | 49,272 | ||||||||

| Finance income | 60,164 | 62,873 | 62,457 | 63,110 | ||||||||

| Deferred tax recovery | 575 | 1,398 | 3,221 | 4,201 | ||||||||

| Finance costs | (471 | ) | (32,871 | ) | (8,944 | ) | (6,741 | ) | ||||

| Loss on fair valuation of embedded derivative liability | (4,171 | ) | (20,727 | ) | (139,271 | ) | (39,961 | ) | ||||

| General administrative expenditure | (10,573 | ) | (12,345 | ) | (14,001 | ) | (14,947 | ) | ||||

| Exploration and project evaluation expenditure | (12,813 | ) | (10,589 | ) | (8,901 | ) | (8,637 | ) | ||||

| Share-based payments | (7,504 | ) | (8,505 | ) | (8,933 | ) | (7,715 | ) | ||||

| Profit (loss) attributable to: | ||||||||||||

| Owners of the Company | 117,942 | 76,401 | (65,552 | ) | 27,739 | |||||||

| Non-controlling interests | (9,760 | ) | (9,885 | ) | (3,858 | ) | (1,980 | ) | ||||

| Total comprehensive income (loss) attributable to: | ||||||||||||

| Owners of the Company | 141,525 | 88,223 | (73,648 | ) | 37,155 | |||||||

| Non-controlling interest | (7,469 | ) | (8,672 | ) | (4,728 | ) | (1,003 | ) | ||||

| Basic profit (loss) per share | 0.09 | 0.06 | (0.05 | ) | 0.02 | |||||||

| Diluted profit (loss) per share | 0.09 | 0.06 | (0.05 | ) | 0.02 | |||||||

| Three months ended | ||||||||||||

| September | June | March | December | |||||||||

| 2023 | 2023 | 2023 | 2022 | |||||||||

| $’000 | $’000 | $’000 | $’000 | |||||||||

| Share of profit from joint venture | 69,829 | 73,066 | 82,659 | 83,324 | ||||||||

| Finance income | 56,671 | 61,956 | 57,826 | 58,477 | ||||||||

| Gain (loss) on fair valuation of embedded derivative liability | 12,218 | (26,618 | ) | (30,900 | ) | (66,600 | ) | |||||

| General administrative expenditure | (9,841 | ) | (10,474 | ) | (8,571 | ) | (11,870 | ) | ||||

| Finance costs | (8,752 | ) | (5,539 | ) | (10,465 | ) | (10,457 | ) | ||||

| Share-based payments | (6,732 | ) | (7,120 | ) | (7,702 | ) | (7,809 | ) | ||||

| Exploration and project evaluation expenditure | (6,264 | ) | (4,375 | ) | (3,381 | ) | (3,887 | ) | ||||

| Deferred tax (expense) recovery | 1,212 | 1,965 | 926 | (3,839 | ) | |||||||

| Profit (loss) attributable to: | ||||||||||||

| Owners of the Company | 112,510 | 92,042 | 86,637 | 41,884 | ||||||||

| Non-controlling interests | (4,988 | ) | (4,859 | ) | (4,157 | ) | (4,705 | ) | ||||

| Total comprehensive income (loss) attributable to: | ||||||||||||

| Owners of the Company | 109,681 | 86,588 | 74,154 | 53,078 | ||||||||

| Non-controlling interest | (5,250 | ) | (5,443 | ) | (5,420 | ) | (3,621 | ) | ||||

| Basic profit per share | 0.09 | 0.08 | 0.07 | 0.03 | ||||||||

| Diluted profit per share | 0.08 | 0.07 | 0.07 | 0.03 | ||||||||

DISCUSSION OF RESULTS OF OPERATIONS

Review of the three months ended September 30, 2024 vs. September 30, 2023

The company recorded a profit for Q3 2024 of $108 million compared to a profit of $108 million for the same period in 2023. The profit for Q3 2023 included a gain on the fair valuation of the embedded derivative financial liability of $12 million, compared to a loss on the fair valuation of the embedded derivative financial liability of $4 million in Q3 2024.

The total comprehensive income for Q3 2024 was $134 million compared to $104 million for Q3 2023. Included in the total comprehensive income for Q3 2024 is an exchange gain on translation of foreign operations of $26 million, resulting mainly from the strengthening of the South African Rand by 6% from June 30, 2024, to September 30, 2024, compared to an exchange loss on translation of foreign operations recognized for the same period in 2023 of $3 million.

Ivanhoe’s exploration and project evaluation expenditure amounted to $13 million in Q3 2024 and $6 million for the same period in 2023. Exploration and project evaluation expenditure for Q3 2024 related mainly to exploration at Ivanhoe’s Western Foreland exploration licences.

Finance income for Q3 2024 amounted to $60 million and was $3 million more than for the same period in 2023 ($57 million). Included in finance income is the interest earned on loans to the Kamoa Holding joint venture to fund past development which amounted to $57 million for Q3 2024, and $52 million for the same period in 2023, and increased due to the higher accumulated loan balance.

The company recognized a loss on the fair valuation of the embedded derivative financial liability of $4 million for Q3 2024, compared to a gain of $12 million for Q3 2023.

The Kamoa-Kakula Copper Complex sold 103,106 tonnes of payable copper in Q3 2024 realizing revenue of $828 million for the Kamoa Holding joint venture, compared to 96,509 tonnes of payable copper sold for revenue of $695 million for the same period in 2023.

The company recognized income in aggregate of $141 million from the joint venture in Q3 2024 and $121 million for the same period in 2023, which can be summarized as follows:

| Three months ended | ||||||

| September 30, | ||||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Company’s share of profit from joint venture | 83,507 | 69,829 | ||||

| Interest on loan to joint venture | 57,077 | 51,561 | ||||

| Company’s income recognized from joint venture | 140,584 | 121,390 | ||||

The company’s share of profit from the Kamoa Holding joint venture was $14 million more in Q3 2024 compared to the same period in 2023 and is broken down in the following table:

| Three months ended | ||||||

| September 30, | ||||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Revenue from contract receivables | 836,871 | 681,821 | ||||

| Remeasurement of contract receivables | (8,983 | ) | 13,014 | |||

| Revenue | 827,888 | 694,835 | ||||

| Cost of sales | (408,919 | ) | (286,030 | ) | ||

| Gross profit | 418,969 | 408,805 | ||||

| General and administrative costs | (22,260 | ) | (32,632 | ) | ||

| Amortization of mineral property | (4,507 | ) | (3,002 | ) | ||

| Profit from operations | 392,202 | 373,171 | ||||

| Finance costs | (83,815 | ) | (85,097 | ) | ||

| Foreign exchange loss | (4,232 | ) | (15,249 | ) | ||

| Finance income and other | 5,737 | 5,323 | ||||

| Profit before taxes | 309,892 | 278,148 | ||||

| Current tax expense | (125,852 | ) | (44,276 | ) | ||

| Deferred tax expense | 34,093 | (55,212 | ) | |||

| Profit after taxes | 218,133 | 178,660 | ||||

| Non-controlling interest of Kamoa Holding | (49,431 | ) | (37,592 | ) | ||

| Total comprehensive income for the period | 168,702 | 141,068 | ||||

| Company’s share of profit from joint venture (49.5%) | 83,507 | 69,829 | ||||

The realized and provisional copper prices used for the remeasurement (mark-to-market) of contract receivables for the three months ended September 30, 2024, and for the same period in 2023, can be summarized as follows:

| Three months ended | ||||||

| September 30, | ||||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Realized during the period – open at the start of the period | ||||||

| Opening forward price ($/lb.)(1) | 4.32 | 3.77 | ||||

| Realized price ($/lb.)(1) | 4.18 | 3.86 | ||||

| Payable copper tonnes sold | 63,633 | 69,089 | ||||

| Remeasurement of contract receivables ($’000) | (20,442 | ) | 16,881 | |||

| Realized during the period – new copper sold in the current period | ||||||

| Provisional price ($/lb.)(1) | 4.15 | 3.83 | ||||

| Realized price ($/lb.)(1) | 4.14 | 3.78 | ||||

| Payable copper tonnes sold | 68,725 | 26,271 | ||||

| Remeasurement of contract receivables ($’000) | (2,088 | ) | (3,040 | ) | ||

| Open at the end of the period – new copper sold in current period | ||||||

| Provisional price ($/lb.)(1) | 4.23 | 3.76 | ||||

| Closing forward price ($/lb.)(1) | 4.41 | 3.76 | ||||

| Payable copper tonnes sold | 34,382 | 70,534 | ||||

| Remeasurement of contract receivables ($’000) | 13,547 | (827 | ) | |||

| Total remeasurement of contract receivables ($’000) | (8,983 | ) | 13,014 | |||

| (1) Calculated on a weighted average basis | ||||||

The finance costs recognized in the Kamoa Holding joint venture can be broken down as follows:

| Three months ended | ||||||

| September 30, | ||||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Interest on shareholder loans | 118,364 | 104,132 | ||||

| Interest on shareholder loans – capitalized as borrowing costs | (80,922 | ) | (40,172 | ) | ||

| Interest on provisional and advance payment facilities | 32,121 | 14,786 | ||||

| Interest on bank loans and overdraft facilities | 10,113 | 2,142 | ||||

| Interest on equipment financing facilities | 2,370 | 2,700 | ||||

| Lease liability unwinding | 1,769 | 1,509 | ||||

| 83,815 | 85,097 | |||||

Review of the nine months ended September 30, 2024 vs. September 30, 2023

The company recorded a profit of $105 million and a total comprehensive income of $135 million for the nine months ended September 30, 2024, compared to a profit of $277 million and a total comprehensive income of $254 million for the same period in 2023.

The profit for the nine months ended September 30, 2023, included a loss on fair valuation of embedded derivative liability of $45 million, compared to a loss on fair valuation of embedded derivative financial liability of $164 million for the same period in 2024.

The total comprehensive income for the nine months ended September 30, 2024 was $135 million compared to a total comprehensive income of $254 million for the same period in 2023 and included an exchange gain on translation of foreign operations of $30 million for the nine months ended September 30, 2024, resulting mainly from the strengthening of the South African Rand by 6% from December 31, 2023, to September 30, 2024, compared to an exchange loss on translation of foreign operations recognized for the same period in 2023 of $23 million.

Ivanhoe’s exploration and project evaluation expenditure amounted to $32 million for the nine months ended September 30, 2024, and was $18 million more than for the same period in 2023 ($14 million). Exploration and project evaluation expenditure for 2024 related mainly to exploration at Ivanhoe’s Western Foreland exploration licences.

As explained in the accounting for the convertible notes section of the company’s MD&A for the three months and nine months ended September 30, 2024, the company recognized a loss on fair valuation of the embedded derivative financial liability of $164 million for the nine months ended September 30, 2024 (2023: loss of $45 million) as well as $28 million of finance costs during the period due to the early redemption of the convertible notes.

Finance income amounted to $185 million for the nine months ended September 30, 2024, and $176 million for the same period in 2023.

Included in finance income is the interest earned on loans to the Kamoa Holding joint venture to fund past development that amounted to $171 million for the nine months ended September 30, 2024, and $149 million for the same period in 2023 and increased due to the higher accumulated loan balance.

The company recognized income in aggregate of $389 million from the joint venture in the nine months ended September 30, 2024 (2023: $375 million), which can be summarized as follows:

| Nine months ended | ||||||

| September 30, | ||||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Company’s share of profit from joint venture | 218,288 | 225,554 | ||||

| Interest on loan to joint venture | 170,591 | 148,990 | ||||

| Company’s income recognized from joint venture | 388,879 | 374,544 | ||||

The company’s share of profit from the Kamoa Holding joint venture was $218 million for the nine months ended September 30, 2024, compared to a profit of $226 million for the same period in 2023, the breakdown of which is summarized in the following table:

| Nine months ended | ||||||

| September 30, | ||||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Revenue from contract receivables | 2,263,184 | 2,071,274 | ||||

| Remeasurement of contract receivables | 97 | 15,066 | ||||

| Revenue | 2,263,281 | 2,086,340 | ||||

| Cost of sales | (1,015,688 | ) | (803,253 | ) | ||

| Gross profit | 1,247,593 | 1,283,087 | ||||

| General and administrative costs | (96,000 | ) | (91,072 | ) | ||

| Amortization of mineral property | (10,343 | ) | (8,603 | ) | ||

| Profit from operations | 1,141,250 | 1,183,412 | ||||

| Finance costs | (228,674 | ) | (264,471 | ) | ||

| Foreign exchange loss | (25,220 | ) | (49,467 | ) | ||

| Finance income and other | 10,846 | 15,511 | ||||

| Profit before taxes | 898,202 | 884,985 | ||||

| Current tax expense | (327,171 | ) | (239,869 | ) | ||

| Deferred tax expense | 16,705 | (64,551 | ) | |||

| Profit after taxes | 587,736 | 580,565 | ||||

| Non-controlling interest of Kamoa Holding | (146,750 | ) | (124,900 | ) | ||

| Total comprehensive income for the year | 440,986 | 455,665 | ||||

| Company’s share of profit from joint venture (49.5%) | 218,288 | 225,554 | ||||

The realized and provisional copper prices used for the remeasurement (mark-to-market) of contract receivables for the nine months ended September 30, 2024, and for the same period in 2023, can be summarized as follows.

| Nine months ended | ||||||

| September 30, | ||||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Realized during the period – open at the start of the period | ||||||

| Opening forward price ($/lb.)(1) | 3.86 | 3.79 | ||||

| Realized price ($/lb.)(1) | 3.81 | 4.19 | ||||

| Payable copper tonnes sold | 35,966 | 57,803 | ||||

| Remeasurement of contract receivables ($’000) | (4,014 | ) | 52,098 | |||

| Realized during the period – new copper sold in the current period | ||||||

| Provisional price ($/lb.)(1) | 4.15 | 3.93 | ||||

| Realized price ($/lb.)(1) | 4.13 | 3.85 | ||||

| Payable copper tonnes sold | 249,780 | 213,492 | ||||

| Remeasurement of contract receivables ($’000) | (9,436 | ) | (36,205 | ) | ||

| Open at the end of the period – new copper sold in current period | ||||||

| Provisional price ($/lb.)(1) | 4.23 | 3.77 | ||||

| Closing forward price ($/lb.)(1) | 4.41 | 3.76 | ||||

| Payable copper tonnes sold | 34,382 | 70,534 | ||||

| Remeasurement of contract receivables ($’000) | 13,547 | (827 | ) | |||

| Total remeasurement of contract receivables ($’000) | 97 | 15,066 | ||||

| (1) Calculated on a weighted average basis | ||||||

The finance costs recognized in the Kamoa Holding joint venture for the nine months ended September 30, 2024 can be broken down as follows:

| Nine months ended | ||||||

| September 30, | ||||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Interest on shareholder loans | 347,622 | 300,903 | ||||

| Interest on shareholder loans – capitalized as borrowing costs | (227,090 | ) | (91,716 | ) | ||

| Interest on provisional and advance payment facilities | 79,893 | 41,480 | ||||

| Interest on bank loans and overdraft facilities | 15,183 | 4,067 | ||||

| Interest on equipment financing facilities | 7,693 | 7,652 | ||||

| Lease liability unwinding | 5,373 | 2,085 | ||||

| 228,674 | 264,471 | |||||

Financial position as at September 30, 2024, vs. December 31, 2023

The company’s total assets increased by $601 million, from $5,000 million as at December 31, 2023, to $5,601 million as at September 30, 2024. The increase in total assets was mainly attributable to the increase in the company’s investment in the Kamoa Holding joint venture by $389 million, the increase in property, plant and equipment of $517 million as project development continued at the Platreef project and Kipushi mine, offset by the decrease in cash and cash equivalents of $394 million.

The company’s investment in the Kamoa Holding joint venture increased by $389 million from $2,518 million as at December 31, 2023, to $2,906 million as at September 30, 2024. The company’s investment in the Kamoa Holding joint venture can be broken down as follows:

| September 30, | December 31, | |||||

| 2024 | 2023 | |||||

| $’000 | $’000 | |||||

| Company’s share of net assets in joint venture | 1,003,554 | 785,265 | ||||

| Loan advanced to joint venture | 1,902,877 | 1,732,286 | ||||

| Total investment in joint venture | 2,906,431 | 2,517,551 |

The company’s share of net assets in the Kamoa Holding joint venture can be broken down as follows:

| September 30, 2024 | December 31, 2023 | |||||||||||

| 100% | 49.5% | 100% | 49.5% | |||||||||

| $’000 | $’000 | $’000 | $’000 | |||||||||

| Assets | ||||||||||||

| Property, plant and equipment | 5,818,641 | 2,880,227 | 4,195,216 | 2,076,632 | ||||||||

| Mineral property | 768,079 | 380,199 | 778,423 | 385,319 | ||||||||

| Indirect taxes receivable | 555,226 | 274,836 | 419,779 | 207,791 | ||||||||

| Current inventory | 435,354 | 215,500 | 435,212 | 215,430 | ||||||||

| Run of mine stockpile | 403,654 | 199,809 | 304,261 | 150,609 | ||||||||

| Long-term loan receivable | 374,244 | 185,251 | 306,594 | 151,764 | ||||||||

| Trade receivables | 346,366 | 171,451 | 241,944 | 119,762 | ||||||||

| Cash and cash equivalents | 152,184 | 75,331 | 72,486 | 35,881 | ||||||||

| Other receivables | 115,999 | 57,420 | 320,143 | 158,471 | ||||||||

| Right-of-use asset | 49,698 | 24,601 | 56,966 | 28,198 | ||||||||

| Prepaid expenses | 4,735 | 2,344 | 81,802 | 40,492 | ||||||||

| Non-current deposits | 1,872 | 927 | 1,872 | 927 | ||||||||

| Deferred tax asset | 599 | 297 | 606 | 300 | ||||||||

| Liabilities | ||||||||||||

| Shareholder loans | (3,844,638 | ) | (1,903,096 | ) | (3,500,105 | ) | (1,732,552 | ) | ||||

| Term loan facilities | (678,538 | ) | (335,876 | ) | (111,193 | ) | (55,041 | ) | ||||

| Advance payment facility | (665,295 | ) | (329,321 | ) | (150,449 | ) | (74,472 | ) | ||||

| Trade and other payables | (327,854 | ) | (162,288 | ) | (471,377 | ) | (233,332 | ) | ||||

| Deferred tax liability | (226,587 | ) | (112,161 | ) | (322,194 | ) | (159,486 | ) | ||||

| Overdraft facility | (208,426 | ) | (103,171 | ) | (177,775 | ) | (87,999 | ) | ||||