FQM Mine Faces Shutdown in Panama After Ruling, Confirms President

Panama’s government said it will shut a $10 billion copper mine owned by First Quantum Minerals Ltd., damping hopes that the company might reach a new deal to keep operating after a supreme court ruling against it.

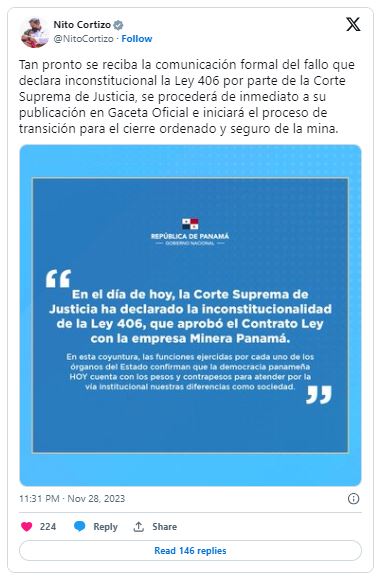

Authorities will start “the transition process for the orderly and safe closure of the mine,” President Laurentino Cortizo said in a post on X Tuesday.

He didn’t say how long the process might take. Production had already been halted after protesters blocked supplies from reaching the mine.

The announcement caps a dramatic six weeks in Panama, after widespread protests erupted over a decision to approve a new multi-decade operating contract for First Quantum’s mine.

Cortizo initially shocked investors by announcing a referendum on the project, but then backtracked to await a ruling from the Supreme Court. On Tuesday, the court unanimously ruled the law approving the contract was unconstitutional.

The closing of the mine would deprive the government of one of its biggest sources of revenue and increases the chances of a protracted legal battle between the Canadian miner and Panama in international arbitration. First Quantum declined to comment on Cortizo’s statement on Tuesday, but said earlier it was studying the supreme court ruling and reserved its legal rights.

The move also threatens to tighten global copper supply — while most analysts are forecasting a surplus in 2024, the glut would be significantly eroded and possibly disappear altogether if the Cobre Panama mine remains closed.

There are bigger concerns in the longer term, with a broad consensus that dozens of new copper mines are needed if the world is going to meet decarbonization goals. Copper traded little changed on Wednesday near a 10-week high.

For First Quantum, a prolonged or permanent closure would remove its biggest producing asset by far, accounting for about half of the company’s expected copper production this year. The Canadian miner has already lost more than half its market value since the protests began last month.

First Quantum shares fell as much as 8.3% Wednesday in Toronto to their lowest intraday price since October 2020.

The implications of the mine closure for Panama’s fiscal outlook are “terrible,” said Ricardo Penfold, a managing director at Seaport Global.

“The country is running a fiscal deficit of 5% of GDP and this will increase it by about 0.6%,” Penfold said, in a written reply to questions. “And then you have the lawsuit.”

The mine has become a lightning rod issue in the run-up to a general election set to be held in Panama next year. While Cortizo can’t run for reelection, he’s been looking to garner support for his center-left party that’s been polling poorly.

The looming election adds to the uncertainty over the mine’s future, and some analysts have speculated that a new government could reconsider the latest decisions and potentially draft a new mining code.

The move to forcibly close a profitable mine with decades of reserves still remaining will also send shockwaves through the wider global industry. More often, governments have enforced tougher tax or royalty regimes or demanded improved environmental performance.

Arbitration is likely to be a last resort for First Quantum. The process can drag on for years and cost millions of dollars in the process.

Canadian mining peer Gabriel Resources Ltd. had planned to build Europe’s biggest miner in Romania, when the project was canned after protesters took to the street.

The company, once worth more than $2 billion, filed its arbitration request back in 2015 seeking $4.4 billion from the country. More than 8 years later, the case has still not been settled.

Environmentalists, labor unions and others have held protests since Oct. 20 when congress passed a contract that gives First Quantum the right to produce copper for 20 years, with the option of another 20-year extension.

Demonstrators argue that the contract violates national sovereignty and didn’t receive sufficient public debate prior to its approval in the legislature. They have vowed to continue protesting until the mine is shut.

First Quantum began to wind down operations last week as small boats blocked the mine’s port, preventing the company from shipping supplies to the mine, while protesters and mining personnel clashed have clashed along the road to the site’s entrance.

SOURCE:mining.com

![]()