Copper price plummets as China faces first GDP drop since 1976

Copper prices dropped on Monday after China released a series of economic data showing the deepest falls in industrial production and property, plant and equipment.

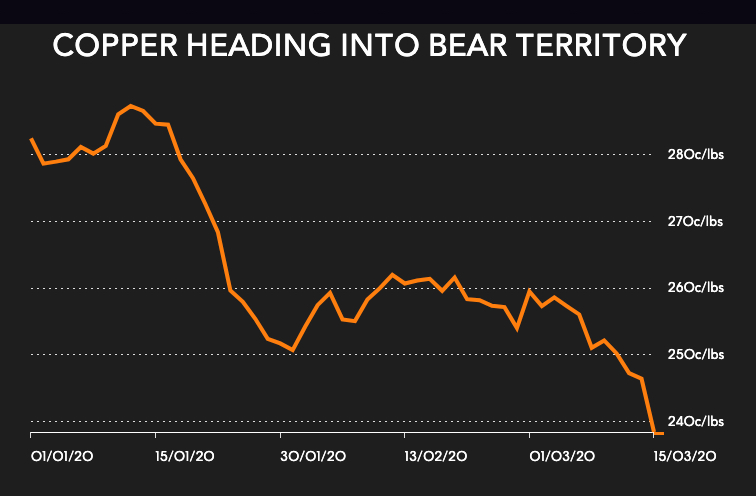

Copper trading in New York fell more than 5% on Monday to a low of $ 2,335 a pound ($ 5,150 a ton), the lowest since early November 2016. The copper price is up from the 2020 high that was hit towards the end, was also down by 19% from January.

Industrial production growth in China declined by 13.5% in January and February compared to the same period last year. The expansion in December was still a healthy 6.9%. It was the lowest in existence and much weaker than the -3% median that Bloomberg’s economists had expected.

Investments in property, plant and equipment decreased by 24.5% in January and February compared to the previous year as the construction sector almost came to a standstill (new construction began by 45% and sales by 40%) and the manufacturing sector stalled as the most migrant workers after the lunar new year break.

In a note, Capital Economics senior Chinese economist Julian Evans-Pritchard, along with a similarly weak service sector and employment figures (five million jobs lost), said that “official GDP growth averaged –13% in the first two months of the year scam”:

This would be unprecedented in China’s modern economic history – GDP growth last shrank in 1976 compared to the previous year.

Evans-Pritchard adds that data may worsen in the coming months as Beijing’s two-month figures mask the fact that the disruption to economic activity in January was still relatively limited.

Copper is particularly vulnerable to more general economic conditions due to its widespread use in power grids, construction, transportation, and industry. China is responsible for more than half of the world’s copper consumption and most of its global production.